Transcript: Matterport 4Q23 & Full 2023 Financial Results Earnings Call19528

Pages:

1

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

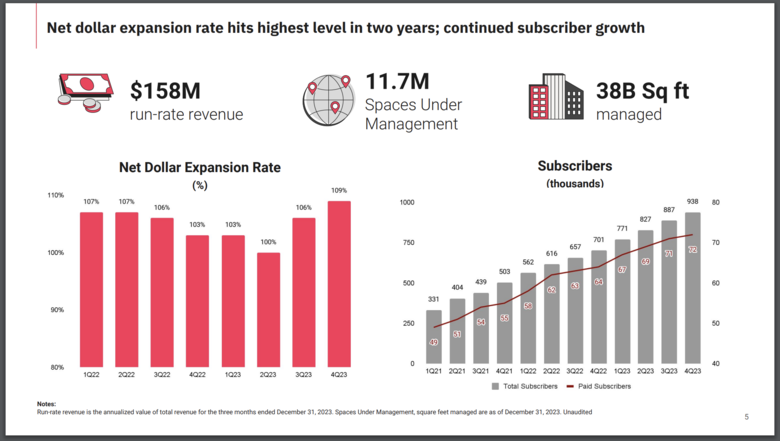

Source: Matterport Deck: February 20, 2024 | Fourth Quarter 2023 Financial Results  Source: Matterport Deck: February 20, 2024 | Fourth Quarter 2023 Financial Results See the Deck Here ====================================================== Matterport Deck (PDF) February 20, 2024 | Fourth Quarter 2023 Financial Results ====================================================== See the Matterport Media Release Here ====================================================== Matterport Announces Fourth Quarter and Full Year 2023 Financial Results Demonstrating Strong Recurring Revenue Growth and Reaffirms 2024 Profitability Target ====================================================== See the transcript of the earnigs call here ====================================================== Transcript: Matterport 4Q23 & Full 2023 Financial Results Earnings Call ====================================================== Transcript: Matterport 4Q23 & Full 2023 Financial Results Earnings Call Source: Matterport RJ: Thanks, Mike. Good afternoon everyone and thank you for joining us today. I’m pleased to report that we closed 2023 with strong fourth quarter results. Total revenue for the quarter was $39.5 million, powered by continued adoption of our solutions from enterprise and small and medium-sized business customers around the globe. Subscription revenue accelerated to 23% year-over-year growth, reaching a record $23.7 million for the period. This was above the high end of our guidance range and demonstrates our platform's growing credibility in boosting productivity and reducing operational costs for customers throughout the industries we serve. Our key metrics continue to grow at a rapid pace, with Spaces Under Management reaching 11.7 million, and our subscriber base expanded to 938,000, reflecting the rapid adoption of our solutions. Subscription revenue growth, gross margin expansion, and continued operating expense discipline drove our loss per share to $0.04, a 56% year-on-year improvement. These results highlight our ability to consistently deliver robust subscription growth while driving significant operating improvements as we continue on our fast-tracked path to positive cash flow - a key milestone we expect to achieve this year. Our dedication to maximizing the customer experience is steadily producing increased retention and expansion, as organizations gain a deeper understanding of the broader applications of our technology, and the impact it delivers. In fact, we saw our net dollar expansion rate improve to 109% from 106% in the prior quarter, the highest level in two years. Reflecting back on 2023, our ability to quickly adapt to changing market conditions paid off. We implemented a comprehensive restructuring to align our business more closely with our core competencies and areas of greatest growth potential. We executed strategies to enhance our company-wide productivity and sales & marketing effectiveness, focusing on investments with the highest ROI for the business. We did this very thoughtfully and expediently, which enabled us to deliver results that bucked several challenging industry trends in 2023. With US home sales down almost 19% and interest rates at decades highs we managed to grow total revenue by 16%. Moreover, we grew residential real estate subscription revenue by 14%. Double digit growth amidst double digit industry declines is a strong testament to our value proposition, even in down markets. What’s more, our subscription revenue outside of real estate, in verticals like facilities management and construction, grew more than 20% in 2023 - demonstrating our diversification strategy is working and providing us with powerful momentum heading into 2024. I’m especially encouraged to report that we digitized more than 9 Billion square feet of real estate in 2023 - to close the year with 38 billion square feet under management - a 36% increase led by Pro3 adoption and usage. This rapid growth is not only a clear indicator of our market leadership, it is pivotal to our product strategy. Our spatial data library, the largest in the industry, unlocks powerful AI-driven insights like Property Intelligence, and sets Matterport further apart from the field. No other solution in the market today can match Matterport’s unique combination of fully automated 3D reconstruction - and automated property and operational insights from the rich data library that we have created. In 2024, we are accelerating our AI solutions strategy, recognizing the transformative impact AI, particularly Large Language Models, is having across industries at a rate and scale reminiscent of the early days of the internet. The realm of the built world is no exception. The era where the novel virtual tour suffices is behind us; the future demands capabilities to comprehend, modify, engage with, and reconceptualize our living spaces, workplaces, and facilities with the same ease that characterizes the rest of our digital experiences today. This year, we are leveraging our extensive spatial data library and immersive imagery in tandem with the capabilities of these groundbreaking generative technologies. This fusion is set to revolutionize our interaction with the built world, marking a significant paradigm shift in how we perceive and engage with our surroundings. To that end, we took a major leap forward last week with the global launch of Property Intelligence, a suite of AI-powered features and new capabilities for the next generation intelligent digital twin. Part of the 2024 Winter Release, Property Intelligence gives customers the ability to instantly understand the details of their property with automated measurements, layouts, editing, and reporting capabilities - all generated from a digital twin. Matterport has consistently led the field in property marketing, setting the standard with our dimensionally accurate 3D virtual tours. Our introduction of Property Intelligence propels us further ahead, introducing a new suite of automated features designed to elevate every property listing, while saving our customers valuable time and effort. At the core of Property Intelligence is our unique spatial data library, encompassing 38 billion square feet of the physical world. Our recent advancements in AI have created a significant opportunity to increase both subscription revenue and market share across the diverse industries we serve. Globally we serve nearly one billion virtual tours each year to millions of visitors - enabling them to walk through their dream home, manage a retail store, inspect a construction project, or operate their facilities remotely. Our advancements in automation and property insights streamline processes and enhance decision-making speed and quality for all digital twin applications. Later this year, we will further enhance the intelligent digital twin with generative AI features, to unlock the full potential of a property or physical space. Building on the focus of automation, the next release will introduce the ability to reimagine what a space could become. Details will be shared in a future update, but it's clear that Property Intelligence and our AI strategy can significantly alter our business trajectory and fuel our long-term growth. As part of our Winter 2024 Release, we are pleased to announce the introduction of Showcase Plugins, which simplify navigation for virtual visitors and facilitate connections with experts. The Compass and Minimap plugins assist in navigating large spaces, homes, job sites, hotels, and more; while the Business Card and Quick Link plugins offer essential contact information and additional details about the property. These features allow real estate agents to personalize virtual tours and enable property or facility managers to enrich spaces with contextual content, such as operations manuals, restaurant menus, reservation pages, and more, ensuring a comprehensive and interactive virtual experience. In an era where real estate agents navigate challenges such as housing affordability, inventory shortages, and the rapid pace of technological advancements, the pressure to adapt is immense. Amidst growing scrutiny over commission structures, agents are under increasing pressure to meet the high expectations of their clients and secure new listings. Our digital twins serve as comprehensive marketing tools, offering agents a competitive edge to attract more qualified buyers, expedite transactions, and increase rental bookings. With enhancements in Property Intelligence, including automatic generation of property reports that detail room dimensions and ceiling heights, along with new branding opportunities for agents, Matterport stands as an essential tool for buying, selling, and renting properties more effectively. The travel and hospitality sector remains a significant source of revenue for us, offering substantial growth opportunities. According to IDC, by 2025, an estimated 50% of travel and hospitality organizations are expected to implement digital twins to enhance efficiency and bookings. The global hospitality market, valued at $4.7 trillion by Statista, has traditionally depended on direct interactions for sales, property assessments, and improvement initiatives. However, the industry is experiencing a fundamental shift towards digital engagement, with immersive technologies playing a pivotal role in marketing efforts. Matterport is at the forefront of this transformation, providing the necessary solutions for customers to capitalize on these digital advancements. Our hospitality clients are increasingly acknowledging the benefits we offer. In the fourth quarter, we entered into a new, multi-year collaboration with Vacasa, utilizing Matterport’s Digital Twin Platform and Capture Services. Vacasa is set to enhance its use of our platform, integrating it thoroughly into its property onboarding and guest services for the numerous properties under its management. Our comprehensive digital twin solutions will allow Vacasa to capture, document, and market its listings more efficiently and effectively. Each digital twin will provide a detailed virtual tour and high-resolution photos, ensuring a uniform showcase experience across Vacasa’s portfolio with just a single capture session. We have also entered into a partnership with Visiting Media, a leading provider of immersive sales enablement and channel distribution solutions for the hospitality industry. Visiting Media, which supports millions of users worldwide and works with top hospitality brands such as Hilton, Hyatt, and IHG Hotels and Resorts, has chosen to expand its utilization of Matterport's property marketing solutions, making our 3D technology the preferred option for the thousands of hotels it serves. With digital twins for over 17,000 spaces, Visiting Media enables hospitality revenue teams to significantly streamline workflows across their properties, aiding property management teams and improving channel distribution efforts. Our presence in the construction industry is rapidly expanding as we further enhance our suite of solutions and partnerships. Recently, we launched the Matterport CAD file add-on, enabling the conversion of Matterport digital twin point clouds into editable CAD drawings in various formats. Given the widespread use of CAD software across the industry, Matterport simplifies as-built documentation processes and accelerates project timelines. The Pro3 has gained significant popularity within the Architecture, Engineering, and Construction (AEC) industry due to its exceptional value for performance in capturing superior imagery and high-fidelity digital twin reconstructions. Our commitment to innovation for our flagship device remains strong. In the fourth quarter, we initiated a beta program for high-density scanning, a software-enabled capture upgrade to increase the precision of our 3D models and simplify professional as-built modeling with Matterport. In 2023, we successfully expanded our portfolio of Fortune 1000 clients, welcoming notable new logos such as John Deere, Siemens, and Danone. We also showcased a collaboration with Bayer, a global leader in pharmaceuticals and biotechnology. Bayer's Crop Sciences division has leveraged Matterport for the design and management of construction projects in Germany and South Africa, transitioning from traditional design processes to digital collaboration. This shift enabled the team to cut project planning expenses by 75% and enhance efficiency across the value chain, from design to construction. We recently formed a strategic partnership with Belden, a premier global provider of network infrastructure and digitization solutions, aimed at offering 3D digital twin-powered connectivity solutions for facilities management in sectors such as industrial automation, smart buildings, and broadband. McKinsey reports that 70% of C-suite technology leaders in large corporations are currently evaluating and investing in digital twins. The synergy between Belden's network solutions and our Digital Twin Platform will empower businesses worldwide to enhance their Connected Worker initiatives, allowing for more efficient management of physical spaces in terms of asset performance, production monitoring, and sustainable manufacturing. Through this collaboration, Matterport will integrate into Belden's edge-to-cloud solutions, bringing our advanced visualization, spatial data, and developer tools to Belden's comprehensive services for secure data handling and management. As members of the Amazon Web Services Partner Network, Matterport and Belden will also collaborate closely with this leading cloud service provider to develop innovative solutions that assist customers in their operational transformation journeys. Before handing over to JD Fay, I'd like to spotlight our latest Environmental, Social, and Governance (ESG) report. Embedded within our core business strategy, our ESG framework reflects our commitment to aiding customers in achieving their sustainability objectives, influencing our everyday decisions. The report underscores the efficiency of Matterport technology as a sustainable alternative to travel, facilitating virtual interaction and operations in environments like construction sites, manufacturing plants, or during home tours. According to 2022 data, Matterport's technology has helped prevent over 756,000 tonnes of carbon emissions since initiating this tracking in 2021. Enhancing support for our clients, we've collaborated with a third-party carbon accounting firm to create an emissions calculator for enterprise customers. This tool offers a tailored analysis of the environmental and economic benefits derived from using the Matterport Digital Twin Platform, soon to be accessible to our enterprise clients. Our platform plays a pivotal role in enabling customers to conduct their operations more sustainably, efficiently, and remotely - from anywhere in the world. I would now like to turn it over to JD Fay to discuss our financial performance for the fourth quarter and our outlook for Q1 and full year 2024. JD: Thank you, RJ. For the fourth quarter, we delivered total revenue of $39.5 million, in line with our guidance range. Subscription revenue rose to $23.7 million, accelerating for the second consecutive quarter to 23% growth, and above the high end of our guidance range. Subscription revenue now represents 60% of total revenue, up from 47% just one year ago. This is by design, as we increase subscription revenue growth and make it a larger percentage of total revenue Our annual recurring revenue was $94.7 million, and we are rapidly approaching the $100 million ARR milestone that we expect to reach this year. The strength was broad-based, and came from growth in new subscribers, expansion of existing subscribers, and price increases we implemented in the middle of 2023. We saw greater than 20% growth in both enterprise and SMB subscription plans and are pleased to share that we now have more than 120 customers with over $50,000 in ARR, up over 30% from the year ago period. We also saw 20% year-on-year growth in the Americas and Asia Pacific regions, and over 30% growth in Europe, the Middle East, and Africa. Our total subscriber base grew 34% from the year ago period. Paid subscribers grew by 13% and free subscribers grew by 36% compared to the year ago period. Our net dollar expansion rate improved again in the fourth quarter to 109%. We saw improvements across SMB and enterprise cohorts, supplementing paid subscriber growth and resulting in the highest average revenue per account we have seen since 2020. We also continue to benefit from higher prices for SMB subscription plans. We were pleased to deliver strong and balanced growth in residential real estate and non-residential real estate vertical markets, with both up over 20% year-over-year, and we continue to see significant strength across Travel & Hospitality, Facilities Management, and Construction markets. We are delivering outsized growth in residential real estate compared to the market as savvy agents leverage our solutions to win more listings, reduce their marketing expenses and enhance their digital content and reach to drive faster sales. Residential real estate represented approximately 50% of subscription revenue in Q4. Services revenue for the fourth quarter was $8.3 million, flat from the year ago period and largely in line with our expectations. Product revenue was $7.5 million in the fourth quarter. Our Black Friday and Cyber Monday promotions drove unit sales, and we elected to extend those promotions through the end of the year. The result was a net positive: while average selling prices declined slightly, we were able to exceed our shipment volume goals for the quarter. Compared to the year-ago period, our Q4 ‘22 product revenue was particularly high, as it was our first full quarter for Pro3 camera sales, and we exceeded our target for Pro2 camera sales in that quarter as supply chain constraints were resolved at that time. Total gross margin for the fourth quarter improved to 53%, compared to 36% in the year ago period. We have made excellent progress with gross margin, including a 300 basis point improvement in subscription gross margin, primarily due to price increases and lower cloud hosting costs, a significant improvement in services gross margin and a recovery in product gross margin as product costs have stabilized. We expect gross margin to continue to trend higher, primarily driven by revenue mix shifts as subscription revenue continues to grow as a percentage of total revenue. Our operating expenses were $38.2 million in Q4, a 12% reduction from the year ago period. Research and Development expense was $7.9 million, a reduction of 24% from the year ago period; and SG&A expenses were $30.4 million, a reduction of 9%. We have made great strides in streamlining operations and organizing ourselves to be more efficient. We expect to continue improving our operating leverage as we close in on positive cash flow from operations later this year. Strong subscription revenue, improving net dollar expansion rates, increased average revenue per account and higher gross margin combined with lower operating expenses to yield a 56% improvement in Non-GAAP loss per share, which was 4 cents for the quarter. Our weighted average share count was 308 million shares. Moving on to the balance sheet, we ended the quarter with $423 million in cash and investments, down less than 2% from the prior quarter. We remain debt free. Our cash used in operations improved to $10.4 million in the quarter, which is a 46% improvement from the year ago period, and our best cash flow performance since becoming a public company. For full year 2023, we delivered record total revenue of $157.7 million. This was up 16% from the prior year, driven by 38% growth in services revenue and 18% growth in subscription revenue. Full year non-GAAP gross margin was 52%, an expansion of 700 basis points, and our non-GAAP loss per share was $0.22, a 46% improvement from the prior year. This loss per share was also 35% better than the full year guidance we provided at the beginning of 2023, which demonstrates our commitment to achieving profitability in the near term, and highlights the success we are seeing with a more efficient, focused team of dedicated Matterport engineers and professionals. Turning to guidance: In light of our Q4 annual recurring revenue, improving trends in gross margin, and disciplined operating expense management, the company is in a strong position to deliver another year of revenue growth and an improvement in net loss as we close in on profitability. To ensure we reach our goal of cash flow profitability by the end of this year, we are controlling our spending while continuing to drive higher subscription revenue growth rates. Our expectations for continued growth in subscription revenue from adoption across new and existing small and medium sized businesses and enterprise customers further enhances the predictability and profitability of our business. For the first quarter of 2024, we expect total revenue to be in the range of $39 million to $41 million, and subscription revenue to be in the range of $24.0 million to $24.2 million. This represents 22% year-on-year growth at the midpoint of the subscription revenue range. We expect the balance of revenue to be split roughly evenly between the services and product revenue lines. We anticipate first quarter Non-GAAP loss per share to be in the range of $0.02 to $0.04 cents, which would represent a 57% improvement from the year ago period and shows that we continue down the path to reach our profitability targets this year. For full year 2024 guidance, we expect total revenue to be in the range of $173 million to $183 million. Full year 2024 subscription revenue is expected to be in the range of $104 million to $106 million. This would represent over 20% growth at the midpoint. Our confidence in the full year comes from the improving trends in subscription revenue that I discussed earlier, along with expectations for adoption of our recently announced suite of AI-powered features and new capabilities for the next generation of intelligent digital twins. For the full year of 2024, we expect a $0.07 to $0.11 cent non-GAAP loss per share. This would be an improvement of $0.13 at the midpoint compared to 2023, or a 59% improvement. Over the past year, our team has done an excellent job to accelerate subscription revenue growth. The mix shift to increased subscription revenue creates a more durable, recurring revenue business model with higher gross margins, and greater fall-through to our operating margins. These mix benefits were evident in 2023 as subscription revenue grew from 52% in Q1 to 60% by Q4. We expect growing average revenue per account and the improved net dollar expansion rate to continue and to solidify our foundation for a strong 2024, and, when combined with disciplined operating expense management, we are positioned to achieve positive cash flow from operations later this year. Further, while this is an important milestone for Matterport, it is also just one step on our path to unlocking the significant operating leverage inherent in our software platform that can deliver even stronger earnings and sustainable cash flows for the years ahead. Now, I would like to turn the call back over to RJ. RJ Closing Thanks JD! 2023 marked a pivotal year of transformation for Matterport, as we streamlined our operations to become a more agile, efficient, and customer-focused organization. This strategic realignment is the cornerstone of our success in exceeding market expectations and the primary reason why our clientele, ranging from large enterprises to small and medium-sized businesses, prefer Matterport in a time when prioritizing cost savings, productivity, and operational efficiency is more crucial than ever. By integrating Matterport into our customers' everyday workflows, we simplify processes, enhancing property intelligence which, in turn, enables buyers and sellers to make more informed decisions. This has led to improved outcomes across the board. Our clients are reporting substantial business value from the adoption of our newest solutions, which is reflected in our rising Net Dollar Expansion rates. Looking ahead, I expect 2024 will be our most promising year to date. Just weeks into the year, we have introduced Property Intelligence, enhancing our digital twins with AI-driven insights and automation that significantly streamline our customers' workflows. We are advancing towards launching our inaugural generative AI solutions, set to revolutionize the way individuals manage and reimagine their properties and spaces. Our momentum is becoming more and more impervious to external market factors like fluctuating interest rates, inflation, and market recoveries in real estate. We are charging full speed ahead, driven by the strong support of our customers and partners, our belief in the transformative potential of our industry leading technology, and our dedication to customer success. We are confident in our strategic direction and remain on course to achieve positive cash flow within the year. The commercialization of advanced AI and data science is precipitating significant changes across all industries, yet a large portion of the built world remains offline and untouched due to various challenges that have hampered its growth. But with the advent of technology like Property Intelligence, it is now possible to unlock substantial value and efficiencies on a large scale. The upside to customers is huge, and the consequences of delayed adoption are even greater. In today's data-driven landscape, companies that leverage digital twins to gain deeper insights, decrease expenses, and increase operational efficiency are poised to thrive in the intensely competitive global marketplace. The time is now for businesses in every sector - from real estate to manufacturing, design, construction, and insurance - to embrace the future. Thank you for joining us today. Operator, we are now ready for questions. |

||

| Post 1 • IP flag post | ||

Pages:

1