12% of 1st-Time Homebuyers Say Selling Crypto Helped Save for Down Payment16189

Pages:

1

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

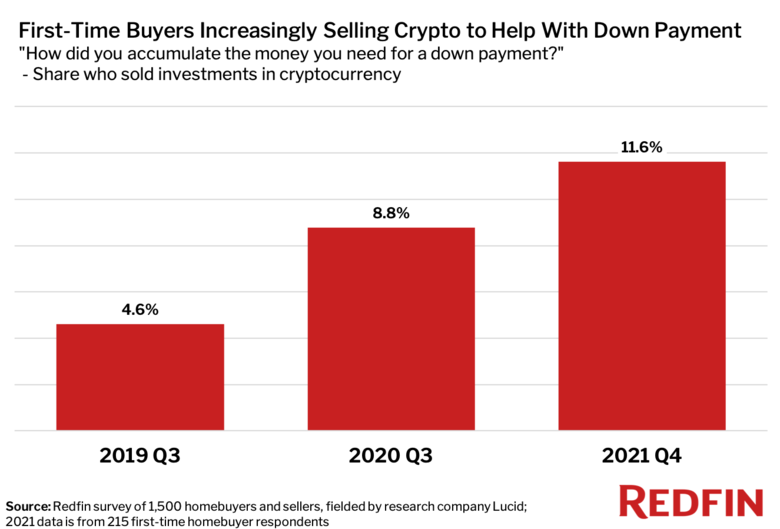

| Redfin Media Release ---  Source: Redfin 12% of First-Time Homebuyers Say Selling Crypto Helped Save for Down Payment, Up From 5% in 2019 Digital currencies are becoming an increasingly common payment method as millennials rush the housing market SEATTLE--(January 7, 2022 via BUSINESS WIRE)-- (NASDAQ: RDFN) — One in nine first-time homebuyers (11.6%) surveyed in the fourth quarter said selling cryptocurrency had helped them save for a down payment, according to a new report from Redfin (www.redfin.com), the technology-powered real estate brokerage. This is up from 8.8% in the third quarter of 2020 and 4.6% in the third quarter of 2019. “With extra time and a lack of exciting ways to spend money, many people began trading cryptocurrencies during the pandemic,” said Redfin Chief Economist Daryl Fairweather. “Some of those investments went up in smoke, but others went ‘to the moon,' or at least rose enough to help fund a down payment on a home.” The report is based on a Redfin-commissioned survey of 1,500 U.S. residents planning to buy or sell a home in the next 12 months, which was fielded to a representative sample of the American population and conducted by research technology company Lucid from December 10 to December 13, 2021. The report focuses on the 215 of those 1,500 respondents who answered the question “How did you accumulate the money you need for a down payment?” which Redfin only posed to participants who indicated they were planning to buy their first home in the next year. The most common response was “saved directly from paychecks” (52%), while less common answers included “cash gift from family” (12%) and “pulled money out of a retirement fund early” (10%). Bitcoin, the world’s largest digital currency, hit a record high of nearly $69,000 in November. Ether, the second most valuable cryptocurrency, also reached an all-time high, though both coins have since lost some of those gains. With surging home prices leading to larger down payments, some buyers are finding non-traditional ways to cover the cost and compete with other bidders. “Crypto is one way for people without generational wealth to win a lottery ticket to the middle class,” Fairweather said. Digital currencies are also likely on the rise as a payment method among homebuyers because millennials and Generation Z are taking up an increasing share of the U.S. housing market. Millennials, who own more cryptocurrency than other generations, now account for more than half of new mortgages. To view the full report, including charts and methodology, please visit Redfin Data Center. About Redfin Redfin (www.redfin.com) is a technology-powered real estate company. We help people find a place to live with brokerage, instant home-buying (iBuying), rentals, lending, title insurance, and renovations services. We sell homes for more money and charge half the fee. We also run the country's #1 real-estate brokerage site. Our home-buying customers see homes first with on-demand tours, and our lending and title services help them close quickly. Customers selling a home can take an instant cash offer from Redfin or have our renovations crew fix up their home to sell for top dollar. Our rentals business empowers millions nationwide to find apartments and houses for rent. Since launching in 2006, we've saved customers more than $1 billion in commissions. We serve more than 100 markets across the U.S. and Canada and employ over 6,000 people. For more information or to contact a local Redfin real estate agent, visit www.redfin.com. To learn about housing market trends and download data, visit the Redfin Data Center. Source: Redfin Via Business Wire |

||

| Post 1 • IP flag post | ||

Pages:

1This topic is archived. Start new topic?