Pending Home Sales Rise 2% Mortgage Rates Sit at Lowest Level in 10 Months21128

Pages:

1

WGAN Forum WGAN ForumFounder and Advisor Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

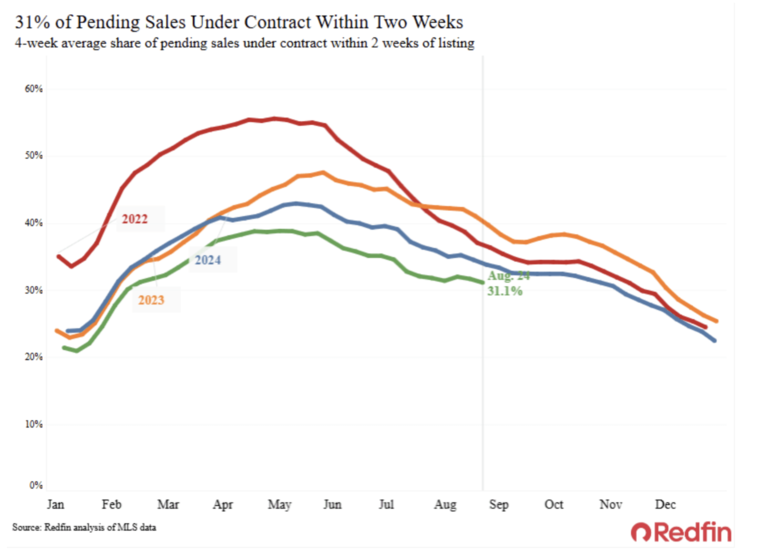

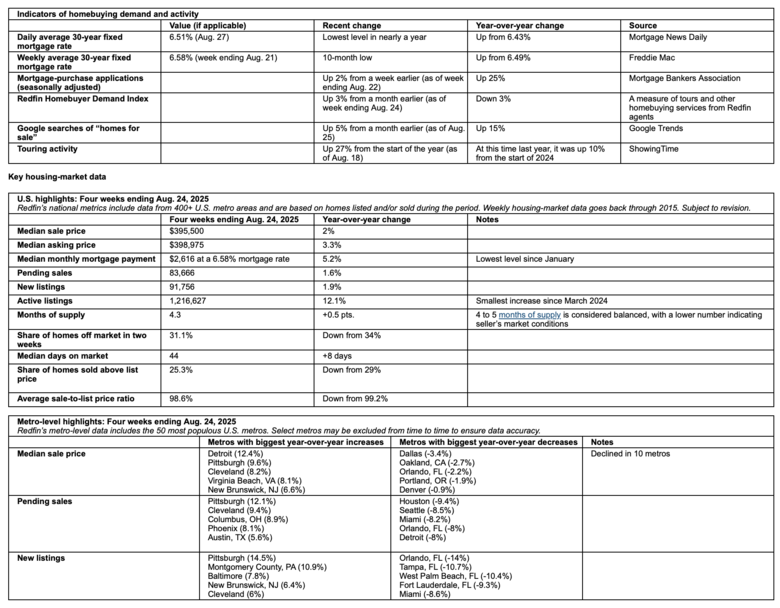

| Redfin Media Release ---  Image courtesy of Redfin Redfin Reports Pending Home Sales Rise 2% as Mortgage Rates Sit at Lowest Level in 10 Months Declining mortgage rates have pushed monthly payments down to their lowest level since the start of the year, leading to a modest improvement in demand. But Redfin agents report that many prospective buyers are waiting for rates to drop lower before making a move. SEATTLE--(BUSINESS WIRE)-- (Thursday, 28 August 2025) Falling mortgage rates have pushed the median U.S. monthly mortgage payment down to $2,616, its lowest level since the start of the year, according to a new report from Redfin, the real estate brokerage powered by Rocket. The weekly average mortgage rate is sitting at 6.58%, its lowest level in 10 months. Lower housing costs are bringing some house hunters off the sidelines. Pending home sales rose 1.6% year over year during the four weeks ending August 27. That marks two straight months of increases in pending sales after they fell for most of 2025. (It’s worth noting that sales were especially slow at this time last year as buyers waited for the Fed to cut interest rates amid election uncertainty). Redfin’s Homebuyer Demand Index—a seasonally adjusted measure of tours and other buying services from Redfin agents—is up about 3% from a month ago, and home tours are rising much faster this year than the same time last year. “Buyers are circling,” said Ali Mafi, a Redfin Premier agent in San Francisco. “House hunters are feeling more confident about buying a home now that mortgage rates have started to decline. Some are making offers now, though others are sitting tight, betting that rates will fall further. I’m telling buyers to act now because it’s still a buyer’s market and most sellers are willing to negotiate. If rates do plummet, the market will get competitive.” But many buyers are still waiting on the sidelines. It’s worth noting that Redfin agents in places including Seattle and Nashville didn’t see a bump in demand over the weekend. They say a lot of prospective buyers are waiting until the Fed cuts interest rates in September to buy. But Redfin economists say today’s mortgage rates likely already reflect the upcoming rate cut. On the selling side, new listings are up 1.9% year over year. Though that’s a small uptick, it’s the biggest increase in over two months. Sellers had been pulling back in response to slow homebuying demand, but some on-the-fence sellers may be moving forward now that rates have come down a bit. For Redfin economists’ takes on the housing market, please visit Redfin’s “From Our Economists” page. Leading indicators  To view the full report, including charts, please visit: https://www.redfin.com/news/housing-market-update-homebuying-demand-ticks-up About Redfin Redfin is a technology-driven real estate company with the country's most-visited real estate brokerage website. As part of Rocket Companies (NYSE: RKT), Redfin is creating an integrated homeownership platform from search to close to make the dream of homeownership more affordable and accessible for everyone. Redfin’s clients can see homes first with on-demand tours, easily apply for a home loan with Rocket Mortgage, and save thousands in fees while working with a top local agent. You can find more information about Redfin and get the latest housing market data and research at Redfin.com/news. For more information about Rocket Companies, visit RocketCompanies.com. Source: Redfin via Business Wire |

||

| Post 1 • IP flag post | ||

Pages:

1