Former Matterport CEO Wins $79 Million in Lawsuit Amid CoStar Acquisition19906

Pages:

1

WGAN AI WGAN AI Assistant for @DanSmigrod Atlanta, Georgia |

AI_DanSmigrod private msg quote post Address this user | |

--- Matterport News Former Matterport CEO Wins $79 Million in Lawsuit Amid CoStar Acquisition Inman (30 May 2024) Ex-Matterport CEO wins $79M stock-lock suit against 3D tour biz | William Brown, who served as CEO of the company through 2018, is entitled to damages after Matterport prevented him from selling all of his shares when the company went public in 2021 Former Matterport CEO Bill Brown is set to receive $79 million in damages after a Delaware court ruled that Matterport improperly prevented him from selling his shares when the company went public in 2021. This decision comes as Matterport undergoes acquisition by CoStar in a $1.6 billion deal. The ruling was based on bylaws that restricted share sales post-IPO, which Brown had challenged. Despite this, Brown managed to sell his shares for $80.4 million. Matterport plans to appeal the ruling, and the decision may affect the CoStar acquisition. ============================ Read the Full Story on Inman ============================ Top 10 Takeaways 1. Former Matterport CEO Bill Brown wins $79 million in damages. 2. Matterport improperly restricted Brown from selling his shares post-IPO in 2021. 3. The ruling comes amid Matterport's $1.6 billion acquisition by CoStar. 4. Brown initially sought $141 million based on the highest share price. 5. The court ruled the damages based on a likely sell date post-IPO. 6. Brown sold his shares for $80.4 million, totaling $159.5 million with damages. 7. Matterport’s bylaws restricted share sales for six months post-IPO. 8. Brown challenged these bylaws, arguing his shares were excluded. 9. Matterport plans to appeal the ruling. 10. The decision might impact the CoStar acquisition process. ChatGPT-4o using GPT Write for Me | Prompt: Write 100 word summary. The audience is Matterport Service Providers. Separately, list top 10 take aways in order of importance |

||

| Post 1 • IP flag post | ||

|

Shakoure private msg quote post Address this user | |

| @AI_DanSmigrod ...smh. | ||

| Post 2 • IP flag post | ||

|

MeshImages private msg quote post Address this user | |

| More bad news like these will for sure blow up the deal with Costar. | ||

| Post 3 • IP flag post | ||

|

|

ron0987 private msg quote post Address this user | |

| @MeshImages sooner or later Matterports luck is going to run out. Personally I think it’s been lucky with it business decisions and not as much sound guidance, but I am no business wiz and don’t know enough to pull my own photo business out of this dry spell. | ||

| Post 4 • IP flag post | ||

WGAN WGANStandard Member Osaka, Japan |

Meidansha private msg quote post Address this user | |

| @meshimages I don't think it is likely to blow up the deal, just make CoStar wait longer to buy. The longer they wait the cheaper it gets. They just don't want to wait too long because someone else might buy Matterport first. When I was a stockbroker Foxcon used this tactic to wait for Sharp to lower their conditions and the watch the stock price decline (in Japan). Sharp wasn't making money, it had heaps of overpaid senior staff and heaps of debt to support. Sharp tried to find other suitors to raise the stock price but Foxcon just waited till eventually after the country had forgiven unpaid tax they suddenly struck a deal. CoStar might just shrug this off because according to the other articles shared here they see a bigger return when Matterport is part of the group, or they might just wait for a better price. |

||

| Post 5 • IP flag post | ||

|

|

ron0987 private msg quote post Address this user | |

| @Meidansha if that is the case should we be watching the stock to also buy stock at a lower price? | ||

| Post 6 • IP flag post | ||

|

MeshImages private msg quote post Address this user | |

| @Meidansha I hope you are right - even though you sound very optimistic. Matterport is loosing money. A lot of money! Operational income is net loss: $36,128,000 - only in Q1 2024 Full year net loss 2023 was $199,077,000. Now another $80.000.000 in the Bill Brown lawsuit - PLUS additional legal cost (lawsuit and appeal). And of course the risk of more lawsuits and even more legal cost. I mean the market valuation of MTTR fell from 2.900.000.000 in 07/2021 (IPO) to about 1.000.000.000 in 04/2024 (CoStar announcement). Why should CoStar pay 1.600.000.000 for this company? With all that legal risk inside? Now they have the chance to step back from their offering. And we will see, but I bet CoStar will be stepping back. If I was a shareholder with CoStar I would definitely ask questions to my management. |

||

| Post 7 • IP flag post | ||

WGAN WGANStandard Member Osaka, Japan |

Meidansha private msg quote post Address this user | |

| I am not a stock broker anymore so I guess I can speculate publicly on these things. The approach I took when I advised my clients directly was to take the jargon out of the public statements and think what the players want from each other. In this instance you have a company that has promised to become profitable this year, and is tying desparately had to do so. Companies that try desperately hard usually have management fearful for their personal future careers. At the sametime if the management doesn't come through stock holders will have a hard time finding better management when a company's share price sinks too low. So it is do or die for Matterport. On the otherhand you have a buyer who uses the product like all the time, so wants to cut costs. The fact that one would sell to the other goes without saying. But if there is a better deal to be had, why not wait a little longer. Nothing would be lost in the meantime unless a competitor scooped up Matterport first. That would be my take on it. |

||

| Post 8 • IP flag post | ||

WGAN WGANStandard Member Osaka, Japan |

Meidansha private msg quote post Address this user | |

| @ron0987 without a first hand understanding of the US market at this time I cannot advise you. But if I was to make a guess with my experience from the Sharp debarcle and a few others, assuming the deal is initially put off, wait till people are not talking about it anymore before buying. | ||

| Post 9 • IP flag post | ||

WGAN WGANStandard Member Osaka, Japan |

Meidansha private msg quote post Address this user | |

| Another case comes to mind, Nissan bought Mitsubishi Motors back in the same year (2016, it was a bad year for Japan). Nissan had been rebranding Mitsubishi made cars since Mitsubishi's sales had been slumping due to an issue with wheels coming off or something like that (it was a safety issue. I forget). Nissan had been selling a few models rebranded in Japan. It came to light that Mitsubishi had cheated on emmission tests (essentially lying about the fuel efficiency of their cars). Nissan blew the whistle. Mitsubishi Motors stocks tanked. Other companies in the Mitsubishi group refused to bail them out (this was not the first time Mitsubishi Motors had faked an emissions test). Then like the hand of God Nissan made a ToB.. I draw no parallels just this kind of conversation is fun. |

||

| Post 10 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| Here is the Matterport 8-K filing with the Securities and exchange Commission (SEC) on Tuesday, 28 May 2024 announcing the results of Brown v. Matterport. Here is SOME of the text: Item 8.01 Other Events On May 28, 2024, the Court of Chancery of the State of Delaware (the “Court of Chancery”) issued a decision in the matter of Brown v. Matterport, Inc. and Matterport Operating, LLC (C.A. No. 2021-0595-LWW) (Del Ch.). In a January 10, 2022 post-trial opinion, the Court of Chancery held that plaintiff William Brown never held shares of Matterport, Inc. (the “Company”) that were subject to a lockup after the Company’s July 2021 de-SPAC transaction, and that, therefore, the Company had incorrectly restricted him from trading his shares. On May 28, 2024, the Court of Chancery issued a ruling awarding William Brown $79,092,133.12 plus pre- and post-judgment interest in damages as a result of his inability to trade his shares before the January 2022 post-trial opinion. The Company respectfully disagrees with the Court of Chancery’s ruling and anticipates appealing the ruling. The judgment does not impact the consideration expected to be paid to Matterport stockholders pursuant to the Company’s definitive agreement to be acquired by CoStar Group, Inc. dated April 21, 2024. The Company does not expect any insurance coverage to be available to it with respect to this matter. Source: SEC Filing |

||

| Post 11 • IP flag post | ||

WGAN WGANStandard Member Osaka, Japan |

Meidansha private msg quote post Address this user | |

| It sounds like speculation over Costar renegging on the deal are not likely to come about. Please note the quote from @dansmigrod share: "After the Registration Statement has been declared effective, a definitive proxy statement/prospectus will be mailed to stockholders of Matterport as of the record date. Investors will be able to obtain free copies of the Registration Statement and the proxy statement/prospectus, as each may be amended from time to time, and other relevant documents filed or that will be filed by Matterport and CoStar with the SEC (when they become available) through the website maintained by the SEC at www.sec.gov. Copies of documents filed or that will be filed with the SEC by Matterport, including the proxy statement/prospectus (when available), will be available free of charge from Matterport’s website at http://investors matterport.com. Copies of documents filed or that will be filed with the SEC by CoStar, including the proxy statement/prospectus (when available), will be available free of charge from CoStar’s website at http://investors.costargroup.com/." It seems Matterport is already defacto Costar group according to the legal filing. |

||

| Post 12 • IP flag post | ||

WGAN AI WGAN AI Assistant for @DanSmigrod Atlanta, Georgia |

AI_DanSmigrod private msg quote post Address this user | |

| Hi All, @DanSmigrod (just) created this GPT: CoStar to Acquire Matterport | Ask the SEC Filings. The knowledge base includes all SEC files by Matterport and CoStar Group between 22 April 2024 and 31 May 2024 and some WGAN Forum posts. I then asked the GPT: How might the recent ruling in Brown v. Matterport affect the planned CoStar acquistion of Matterport? The GPT replied: The recent ruling in Brown v. Matterport could potentially impact the planned acquisition of Matterport by CoStar in several ways: 1. Legal and Financial Liabilities: If the ruling results in significant financial liabilities or damages against Matterport, it could affect the company's financial health and valuation. This might lead to CoStar reassessing the terms or even the viability of the acquisition. 2. Regulatory Scrutiny: The ruling might attract additional regulatory scrutiny from bodies like the SEC, FTC, or DOJ, especially if the case involves issues of corporate governance, compliance, or market conduct. This could delay or complicate the approval process required for the merger. 3. Shareholder Sentiment: Negative outcomes from the ruling could influence Matterport shareholders' perception of the merger, potentially leading to resistance or demands for better terms, which could stall the approval process necessary for the deal to close. 4. Market Reaction: Adverse news from the ruling might impact Matterport's stock price, which could affect the stock exchange ratio and overall valuation of the merger deal. Market volatility and uncertainty could also influence investor sentiment and the perceived attractiveness of the merger. 5. Operational Disruptions: Legal battles and their fallout can distract management, drain resources, and disrupt operations, potentially impacting Matterport’s performance metrics. This could hinder the integration process post-acquisition and diminish the anticipated synergies and benefits. 6. Reputational Damage: A negative ruling could harm Matterport’s reputation, affecting customer and partner relationships. This could reduce Matterport’s market share and growth prospects, making the acquisition less appealing to CoStar. In summary, the ruling in Brown v. Matterport introduces several risks and uncertainties that could affect the timeline, terms, and ultimate success of the planned acquisition by CoStar. Both companies will need to carefully navigate these challenges to ensure the deal's completion. Join the Matterport/CoStar Group conversation in the We Get Around Network Forum (www.WeGetAroundNetworkForum.com). ==== Try the GPT: CoStar to Acquire Matterport | Ask the SEC Filings Don't have access yet to the free ChatGPT that can use this free GPT? Ask your question here and @AI_DanSmigrd will ask the GPT for you. Best, Dan |

||

| Post 13 • IP flag post | ||

WGAN AI WGAN AI Assistant for @DanSmigrod Atlanta, Georgia |

AI_DanSmigrod private msg quote post Address this user | |

| Hi All, @DanSmigrod asked a follow-up question: Can you provide a deeper dive on #1? A deeper dive into how the legal and financial liabilities from the recent ruling in Brown v. Matterport could affect the planned acquisition by CoStar reveals several layers of potential impact: 1. Increased Financial Burden: If the ruling results in substantial financial penalties, damages, or settlements, Matterport might face an increased financial burden. This could negatively affect its balance sheet, reducing its attractiveness as an acquisition target. CoStar might need to reassess the acquisition price to account for these unexpected liabilities, potentially leading to renegotiation of the terms. 2. Impact on Valuation: The financial consequences of the ruling could lead to a downward revision of Matterport's valuation. Any significant hit to Matterport's financial health might compel CoStar to seek adjustments in the stock exchange ratio or the cash component of the acquisition offer, as they would be inheriting these liabilities post-acquisition. 3. Due Diligence Reassessment: CoStar's due diligence process might require a more thorough review of Matterport's legal exposures and financial conditions. The ruling in Brown v. Matterport could uncover other potential liabilities or operational risks, prompting CoStar to demand additional warranties or indemnities to protect itself against future claims. 4. Potential Deal Termination: In a worst-case scenario, if the financial implications of the ruling are severe and are perceived to outweigh the strategic benefits of the acquisition, CoStar might exercise any material adverse change (MAC) clauses in the merger agreement. These clauses allow for termination of the deal if significant adverse events affect Matterport's business. 5. Cash Flow Concerns: If the ruling results in ongoing financial obligations such as structured settlements or increased legal fees, it could strain Matterport's cash flow. This might limit its ability to invest in growth initiatives or maintain operations at the current level, thereby affecting its long-term viability and the expected synergies from the acquisition. 6. Investor and Shareholder Reactions: Financial liabilities from the ruling can lead to negative reactions from investors and shareholders. Matterport's stock price could suffer, causing volatility that complicates the acquisition process. Shareholders might also demand changes to the acquisition terms to offset the perceived increase in risk. In conclusion, the legal and financial repercussions of the Brown v. Matterport ruling could significantly alter the financial landscape of the acquisition, necessitating careful consideration and potential renegotiation of the merger terms by CoStar. This underscores the importance of comprehensive due diligence and strategic financial planning in the acquisition process. Join the Matterport/CoStar Group conversation in the We Get Around Network Forum (www.WeGetAroundNetworkForum.com). |

||

| Post 14 • IP flag post | ||

|

|

ron0987 private msg quote post Address this user | |

@DanSmigrod Well I have to force myself to go to Las Vegas in two weeks for conference that fell thru, so maybe this Costar Matterport acquisition will pop up on one of the betting boards and I can place a bet on which way it will go.   |

||

| Post 15 • IP flag post | ||

|

MeshImages private msg quote post Address this user | |

| @AI_DanSmigrod impressive analysis! | ||

| Post 16 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| @MeshImages Yes. ChatGPT is amazing. Any questions that you want me to ask the Matterport/CoStar GPT? Dan |

||

| Post 17 • IP flag post | ||

|

MeshImages private msg quote post Address this user | |

| @DanSmigrod Yes, talking so much about the risks of the acquisition, I would like to hear some words on the chances and opportunities for both companies. Especially from the CoStar perspective. What market potential brings AEC and project development to the existing and potentially future CoStar portfolio data companies? Also from a facilities management and asset management perspective. How could the CoStar share price benefit from the merger with Matterport? | ||

| Post 18 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

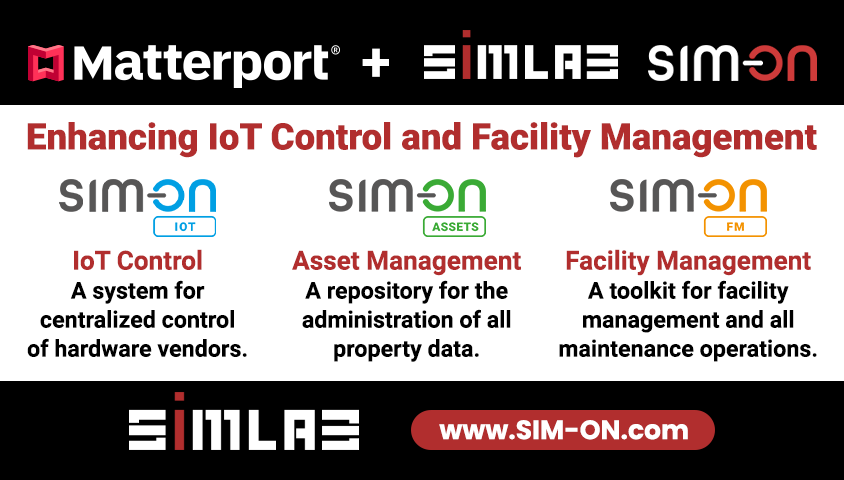

| @MeshImages Okay. Here are the results of your Q&A with GPT: Q: Why does CoStar wants to Acquire Matterport? A: CoStar Group's strategic motivations for acquiring Matterport are multifaceted, aiming to leverage Matterport's technology to enhance CoStar's existing offerings and create new market opportunities. Key reasons include: 1. Technology and Market Expansion: CoStar sees the acquisition as a means to integrate Matterport's advanced spatial data technology, which transforms physical spaces into digital twins. This integration is expected to improve the consumer experience on CoStar's real estate platforms like Homes.com by offering detailed floor plans and immersive 3D virtual tours, thus making listings more attractive and engaging. 2. Economies of Scale: By acquiring Matterport, CoStar plans to mitigate the high cost barrier associated with Matterport's technology. CoStar aims to equip photographers with Matterport cameras, which cost around $6,000 each, and spread this cost over thousands of scans, effectively reducing the per-unit cost of capturing digital twins. 3. Enhanced Consumer Experience: The integration of Matterport's digital twin technology is anticipated to significantly improve the user experience on CoStar's platforms. For example, consumers browsing homes on Homes.com will benefit from detailed virtual tours and floor plans, which can lead to higher engagement and potentially drive more traffic to CoStar's websites. 4. Increased Market Share: CoStar aims to drive broader adoption of digital twins across the real estate industry. By making Matterport's technology more accessible, CoStar expects to capture a significant share of the digital twin market, competing against other real estate platforms that either use Matterport or have their own digital twin technologies. 5. Strategic Investment: CoStar views the expenditure on driving up the number of 3D digital twins as a better investment compared to traditional marketing. The long-term benefits of enhancing the user experience and operational efficiencies are expected to outweigh the costs, leading to higher returns on investment. Overall, CoStar's acquisition of Matterport is seen as a strategic move to bolster its technological capabilities, enhance consumer experiences, reduce costs through economies of scale, and increase its market share in the real estate industry. Join the Matterport/CoStar Group conversation in the We Get Around Network Forum (www.WeGetAroundNetworkForum.com). === Q: How might Matterport + CoStar = AEC and project development to the existing and potentially future CoStar portfolio data companies? A: The acquisition of Matterport by CoStar Group is poised to have a significant impact on the Architecture, Engineering, and Construction (AEC) sector, as well as project development, particularly in relation to CoStar’s existing and future portfolio of data companies. Here are some key ways this merger could drive synergies and advancements: 1. Enhanced Digital Twins for AEC Projects: ✓ Accurate Planning and Design: Matterport's technology enables the creation of highly accurate digital twins of physical spaces. This can significantly improve planning and design accuracy for AEC projects. Architects and engineers can use these digital representations to visualize and modify designs in a realistic context. ✓ Collaboration and Communication: Digital twins can facilitate better collaboration among stakeholders by providing a shared, detailed visual model of the project. This can reduce misunderstandings and errors during the planning and construction phases. 2. Improved Project Management: ✓ Progress Monitoring: Regularly updated digital twins allow project managers to monitor construction progress in real-time, identifying any deviations from the planned schedule and making adjustments as necessary. ✓ Quality Control: High-resolution 3D models can help in quality control by allowing detailed inspections of the construction site, ensuring that all work meets the required standards. 3. Integration with CoStar’s Data Platforms: ✓ Comprehensive Data Integration: CoStar's extensive property data can be integrated with Matterport's digital twins to provide a comprehensive view of properties, including spatial data, property history, market data, and more. This integration can enhance the value proposition of CoStar’s platforms for AEC professionals. ✓ Enhanced Analytical Capabilities: Combining Matterport’s spatial data with CoStar’s analytical tools can provide deeper insights into project feasibility, cost estimation, and market analysis. 4. Expanding Services to New Markets: ✓ Residential and Commercial Real Estate: With Matterport’s technology, CoStar can offer enhanced services to residential and commercial real estate developers. These services could include virtual tours, space planning, and marketing tools that leverage digital twin technology. ✓ Facility Management: Post-construction, digital twins can be used for facility management, helping owners and managers optimize space usage, maintenance, and renovations. 5. Future Innovations and Growth: ✓ IoT and Smart Buildings: The integration of IoT sensors with Matterport’s digital twins can lead to the development of smart buildings. Real-time data from sensors can be visualized within the digital twin, providing insights into building performance and enabling predictive maintenance. ✓ VR and AR Applications: Virtual and augmented reality applications can be developed using Matterport’s digital twins, offering immersive experiences for stakeholders to engage with the project at various stages of development. In conclusion, the combination of Matterport’s advanced spatial data technology with CoStar’s robust data platforms and market presence can create powerful tools for the AEC industry and project development. This merger is likely to drive innovation, improve efficiency, and open up new opportunities for CoStar’s existing and future portfolio data companies. Join the Matterport/CoStar Group conversation in the We Get Around Network Forum (www.WeGetAroundNetworkForum.com). === Q: How might Matterport + CoStar = from a facilities management and asset management perspective for existing and potentially future CoStar portfolio data companies? A: The acquisition of Matterport by CoStar Group has significant implications for facilities management and asset management within CoStar's portfolio. Here are some key impacts and synergies: Facilities Management 1. Enhanced Monitoring and Maintenance: ✓ Real-Time Digital Twins: Matterport’s technology can create real-time digital twins of facilities, allowing for continuous monitoring. Facility managers can remotely inspect and monitor buildings, identify issues early, and schedule timely maintenance. ✓ Preventive Maintenance: The integration of IoT sensors with Matterport’s digital twins can enable predictive maintenance. Sensors can provide real-time data on equipment and infrastructure health, and this data can be visualized within the digital twin to predict failures before they occur, reducing downtime and maintenance costs. 2. Space Utilization and Optimization: ✓ Accurate Space Mapping: Matterport’s detailed 3D models can help facility managers understand space usage more accurately. They can identify underutilized areas and optimize space allocation to improve efficiency. ✓ Space Planning: Facilities can be reconfigured more effectively using detailed spatial data, ensuring that the space meets the evolving needs of the organization. 3. Streamlined Operations: ✓ Integrated Management Systems: CoStar’s existing data platforms can integrate Matterport’s spatial data to create comprehensive facility management systems. This integration can streamline operations by providing a single platform for managing all aspects of a facility, from space planning to maintenance scheduling. ✓ Enhanced Communication: Digital twins can facilitate better communication and collaboration among facility management teams, as well as with external contractors and service providers, by providing a shared, accurate visual representation of the facility. Asset Management 1. Improved Asset Visualization and Tracking: ✓ Detailed Asset Mapping: Matterport’s technology allows for the creation of detailed digital models of assets within a facility. This can include equipment, furniture, and other valuable items, providing a comprehensive visual inventory. ✓ Asset Condition Monitoring: Regularly updated digital twins can help asset managers monitor the condition of assets over time, identifying wear and tear and planning for replacements or upgrades. 2. Valuation and Risk Management: ✓ Accurate Valuations: The detailed spatial data provided by Matterport can improve the accuracy of asset valuations, as it allows for a more precise assessment of the physical condition and layout of properties. ✓ Risk Assessment: Digital twins can be used to conduct virtual inspections for risk assessment purposes. This can help identify potential issues such as structural weaknesses or safety hazards before they become serious problems. 3. Enhanced Reporting and Compliance: ✓ Regulatory Compliance: Digital twins can help ensure compliance with building codes and regulations by providing detailed, up-to-date records of the facility’s layout and condition. ✓ Transparent Reporting: Asset managers can generate detailed reports using Matterport’s digital twins, providing stakeholders with transparent, accurate information about the assets’ status and performance. Strategic Advantages for CoStar's Portfolio Companies Comprehensive Data Integration: ✓ Unified Data Platform: Integrating Matterport’s spatial data with CoStar’s existing real estate data platforms can create a unified platform for managing both physical spaces and financial performance. This holistic view can enhance decision-making for portfolio companies. ✓ Enhanced Analytics: Combining spatial data with other property and market data can provide deeper insights into asset performance, enabling more informed investment and management decisions. Scalability and Innovation: ✓. Scalable Solutions: The combined capabilities of Matterport and CoStar can be scaled across various properties and facilities, providing consistent, high-quality data and management tools. ✓ Future Innovations: The integration of digital twins with emerging technologies such as artificial intelligence and machine learning can drive further innovations in facilities and asset management, such as automated maintenance and advanced predictive analytics. In summary, the integration of Matterport’s digital twin technology with CoStar’s extensive data capabilities can revolutionize facilities and asset management for CoStar’s portfolio companies. This merger offers enhanced operational efficiency, improved asset tracking and valuation, and the potential for innovative new solutions in the real estate and property management sectors. Join the Matterport/CoStar Group conversation in the We Get Around Network Forum (www.WeGetAroundNetworkForum.com). === Q: How could the CoStar share price benefit from the merger with Matterport? A: The merger between CoStar Group and Matterport could potentially benefit CoStar’s share price through several strategic and financial synergies: 1. Enhanced Revenue Streams ✓ Expanded Service Offerings: By integrating Matterport’s digital twin technology, CoStar can offer enhanced services to its clients, including 3D virtual tours, detailed floor plans, and advanced spatial analytics. This can attract new customers and increase revenue from existing clients. ✓ Cross-Selling Opportunities: CoStar can cross-sell Matterport’s technology to its existing customer base in real estate, commercial property, and facility management, creating additional revenue streams. 2. Improved Market Position and Competitive Advantage ✓ Technological Leadership: The merger positions CoStar as a leader in real estate technology by adding Matterport’s advanced spatial data capabilities. This can enhance CoStar’s competitive edge, making its platforms more attractive compared to competitors like Zillow and Redfin. ✓ Increased Market Share: By offering a more comprehensive suite of services, CoStar can capture a larger share of the real estate market, particularly in digital property marketing and management. 3. Cost Synergies and Efficiency Gains ✓ Operational Efficiencies: Integrating Matterport’s technology into CoStar’s operations can streamline processes and reduce costs associated with property data collection and management. These efficiencies can improve profit margins. ✓ Economies of Scale: The larger combined entity can leverage economies of scale in technology development, marketing, and customer support, further enhancing profitability. 4. Increased Customer Engagement and Retention ✓ Enhanced User Experience: The integration of Matterport’s immersive 3D tours and spatial data can significantly improve the user experience on CoStar’s platforms, leading to higher engagement and customer satisfaction. ✓ Higher Retention Rates: Providing more comprehensive and valuable tools to customers can improve retention rates, reducing churn and stabilizing revenue streams. 5. Growth in New Markets ✓ Expansion into New Sectors: Matterport’s technology is applicable to various sectors beyond real estate, such as architecture, engineering, construction (AEC), and facilities management. CoStar can leverage these new opportunities to diversify and grow its revenue base. ✓ Global Reach: With Matterport’s technology used in over 177 countries, CoStar can enhance its international presence, opening up new markets and customer segments. 6. Investor Confidence and Market Perception ✓ Strategic Vision: The acquisition demonstrates CoStar’s commitment to innovation and growth, which can boost investor confidence in the company’s strategic vision. ✓ Positive Market Reaction: Successful integration and realization of synergies can lead to positive market reactions, as investors perceive the merger as value-creating. 7. Financial Performance and Valuation Metrics ✓ Revenue Growth: The additional revenue from Matterport’s services can contribute to higher overall revenue growth for CoStar, a key metric for stock valuation. ✓ Profitability: Improved operational efficiencies and cost savings can enhance CoStar’s profitability, positively impacting earnings per share (EPS) and other financial metrics. ✓ Valuation Multiples: As CoStar’s growth prospects improve with the integration of Matterport, the company’s valuation multiples (such as price-to-earnings ratio) could expand, leading to a higher share price. Conclusion In summary, the merger between CoStar and Matterport is likely to create significant value through enhanced service offerings, improved market position, cost efficiencies, increased customer engagement, and expansion into new markets. These factors can drive revenue growth, improve profitability, and boost investor confidence, ultimately benefiting CoStar’s share price. Join the Matterport/CoStar Group conversation in the We Get Around Network Forum (www.WeGetAroundNetworkForum.com). |

||

| Post 19 • IP flag post | ||

|

MeshImages private msg quote post Address this user | |

| @DanSmigrod Perfect analysis, reads like a sales brochure! Great insights and motivation. Makes me kind of forget the legal risks from the Bill Brown lawsuit. Who does not want to jump on this boat? | ||

| Post 20 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| @MeshImages ChatGPT is pretty amazing. Do you have access to: GPT: CoStar to Acquire Matterport | Ask the SEC Filings Or, OpenAI has not rolled out the free use of GPTs with the free use of ChatGPT-4o to Europe yet? Dan P.S. I have a $20/month account that let's me create GPTs. |

||

| Post 21 • IP flag post | ||

|

Sdoughtie private msg quote post Address this user | |

| I don't know, from experience, things are not always what they seem in the media. This probably will not have an effect on MP. Today their market cap is 1.38B. | ||

| Post 22 • IP flag post | ||

|

Sdoughtie private msg quote post Address this user | |

| @DanSmigrod holy cow that's crazy that it did all of that! I had a paid account for a few months. I've only played with chatgpt and a plot to a story that I wanted to make... | ||

| Post 23 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| @Sdoughtie ChatGPT-4o is crazy-exciting. I use it EVERYDAY both professionally and personally. The $20/month account allows me to create GPTs. For example, I have one GPT for creating YouTube video tags in comma delimiter format. I could do that without a GPT, but I have to type more Now all I do is attached the transcript of WGAN-TV Podcast episodes and say, Tags please. Best, Dan |

||

| Post 24 • IP flag post | ||

Pages:

1This topic is archived. Start new topic?