Will Matterport be Acquired by Hexagon?16479

Pages:

1

WGAN Forum WGAN ForumFounder and Advisor Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

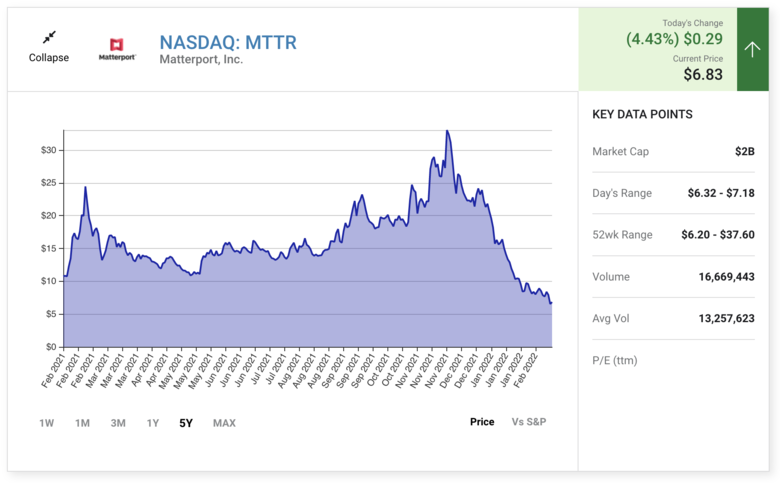

Souce: The Motley Fool | Here's Why Matterport Just Hit a New All-Time Low on Thursday | 17 February 2022 WGAN-TV | How Architects Leverage Matterport Tours Shot with a Leica BLK360 | Guest: Immersaf Media Principal Matt Crowder @MattSCrowder | Thursday, 3 February 2022 | Episode Number: 133 | See an apples-to-apples comparison of the Matterport MatterPak point cloud versus the Leica Cyclone REGISTER 360 software point cloud created from the scan Leica BLK360 scan of a gym in this WGAN-TV Live at 5 show that aired Thursday, 3 February 2022: How Architects Leverage Matterport Shot with a Leica BLK360. The side-by-side comparison begins at 29:50 into episode #123.) Video: Introduction to Leica BLK2FLY with Andy Fontana | Video courtesy of Leica BLK YouTube Channel | 2 February 2022 Scanning an Entire Building with Leica BLK2FLY and Andy Fontana | Video courtesy of Leica BLK YouTube Channel | 2 February 2022 Video: How to Scan with the Leica BLK ARC and Boston Dynamics Spot Robot | Video courtesy of Leica BLK YouTube Channel | 2 February 2022 Video: 68. Will Matterport be Acquired by Hexagon? | #MTTR #HXGBY | Video courtesy of www.WGAN-TV.com YouTube Channel | Monday, 21 February 2022 WGAN Forum Podcast #68 Will Matterport be Acquired by Hexagon? Commentary and Analysis by Dan Smigrod Founder and Managing Editor We Get Around Network Forum and WGAN-TV Live at 5 Monday, 21 February 2022 My manicurist, Brenda, told me Friday (18 February 2022) that she is thinking about buying Matterport, Inc. (NASDAQ: MTTR) stock, after a friend told her about how Matterport had been trading as high as $37.60 per share after going public via a SPAC deal at $10 per share and Matterport was now trading at $6.83 per share; near its low of $6.20 per share. “I’ll invest $500. It will be fun,” Brenda told me with a smile. (Brenda initially said the company was Matterhorn and didn’t mention the specific dollar amounts or SPAC, but that was the gist of what her friend told her.) I could imagine that Ola Rollén, President and CEO of Stockholm, Sweden-based Hexagon AB is thinking nearly the same thing: buy Matterport now for a few billion dollars while Matterport is trading at its surprising “blue-light special” pricing. While Matterport begins every media release with “Matterport, Inc., the leading spatial data company driving the digital transformation of the built world,…” that statement is likely a much-much-much better description of the much-much-much bigger Hexagon. “Our Vision: A future where data is fully and autonomously leveraged so that business, industry and humanity sustainably thrive,” writes Hexagon on its website. “Our Mission: Putting data to work to enable autonomous, connected ecosystems that boost efficiency, productively and quality for our customers.” Aside from the lofty words, what do the two companies have in common? 1. In 2017, Hexagon was among Matterport’s first strategic technology alliances resulting in the Hexagon’s $18,500 Leica BLK360 scanner/camera – paired with the Matterport Capture app – to create high-end digital twins of spaces where the Matterport Pro2 3D Camera falls short (such as scanning outdoors; scanning at much greater distance; and scanning data at a greater level of detail). 2. Also in 2017, Matterport and Hexagon’s Multivista division announced deep scanning integration for 3D visualization of cloud-based construction progress documentation – leveraging Matterport’s API and SDKs – even before these tools were fully developed and started licensing to the now 150+ Matterport Partners. The potential acquisition of Matterport by Hexagon would be strategic. Matterport could scale faster in the architecture, engineering and construction (AEC) space with the help of Hexagon. And, Hexagon would benefit from the Matterport cloud-hosted platform with Matterport Partner integrations. The two companies literally speak the same language: spatial data meets AEC. The integration of the Leica BLK360 and Multivista are just two "small" examples. Hexagon could grow faster with the help of Matterport; particularly if Hexagon has 100 percent control of the Matterport technology and the Matterport technology road map to focus on AEC. Matterport is great at spin (pun intended): “Real estate is the world’s largest asset class comprising commercial, industrial, and residential properties,” says Matterport. “Worth an estimated $230 trillion, the global real estate market is more than three times the estimated value of all global equities combined. With more than four billion buildings worldwide, the built world is the largest undisrupted market with less than 1% digitized.” Despite Matterport’s hyperbole that might lead you to believe that Matterport is the only company capable of digitizing all four billion plus buildings worldwide, The reality is that Matterport limitations include: 1. capturing spatial data of outdoor exterior building facades 2. capturing spatial data of high ceilings more than a couple stories tall 3. capturing spatial data with the Level of Detail needed for many commercial real estate spaces and AEC use cases 4. capturing spatial data of large spaces quickly 5. capturing spatial data autonomously Leica’s recently introduced BLK2FLY (See Video Here) autonomous flying LiDAR drone and BLK ARC (See Video: paired with Boston Dynamics’ Spot: fully autonomous reality capture robot) solve all of these Matterport limitations in one of Matterport’s self proclaimed sweet-spot verticals: AEC. And, while I predict Matterport will build and sell a Leica BLK360 clone for less than $7,500 in 2022, Leica will always run circles around Matterport camera/scanners. (See an apples-to-apples comparison of the Matterport MatterPak point cloud versus the Leica Cyclone REGISTER 360 software point cloud created from the scan Leica BLK360 scan of a gym in this WGAN-TV Live at 5 show that aired Thursday, 3 February 2022: How Architects Leverage Matterport Shot with a Leica BLK360. The side-by-side comparison begins at 29:50 into episode #123.) One might look at Matterport versus Hexagon as a David versus Goliath story. Matterport with its recently announced $108 million annual revenue run rate; $1.77 billion market capitalization; and hundreds of employees versus Hexagon’s $4.3 billion in annual sales; $37.8 billion market cap with 20,500+ employees worldwide. Hexagon has 40 times more revenue than Matterport; 21 times more market cap; and 30 times more employees. The David versus Goliath story is much more interesting and compelling with the two collaborating rather than competing. Collaboration to achieve exponential growth would be much easier if Matterport was a division of Hexagon. Matterport plus Hexagon is a great example of where 1 plus 1 could equal 100: certainly at least 10. I could imagine that Matterport subscriptions – with a gross margin of 78 percent – would be an easier sell by Hexagon than Matterport in the AEC space. Additionally, while Matterport early successes were in 3D models for residential real estate – a space that it had virtually no competition when it launched its Matterport Pro1 3D Camera in 2014, today We Get Around Network Forum (www.WGANForum.com) curates a list of 170 3D/360 virtual tour/digital twin platforms/software – many that are “good enough” to compete with Matterport for residential real estate on speed of capture (resulting in an attractive lower price for mostly self-employed, price sensitive, real estate agents). Despite the first-class, industry-leading “walk-around” experience of a Matterport virtual tour in the residential real estate space, Matterport’s strength is spatial data – a digital moat – that will get deeper and wider with its January acquisition of Enview, Inc., to provide enterprise with deep insights and analytics of physical spaces via “scalable, artificial intelligence (AI) for 3D spatial data” using Matterport 3D spatial data for data sets. According to the Matterport media release announcing the acquisition: “Enview’s technology performs a variety of 3D spatial operations, including object recognition, feature extraction, feature-based change detection, 2D and 3D measurement and attribution. The company’s Explore product is designed to democratize and automate the previously manual task of extracting insights from complex, sensor-fused 2D and 3D data.” Enview’s AI technology – now Matterport’s AI technology – would be a great addition for Hexagon and its customers. Matterport and Hexagon are completely aligned in vision and mission. “Our legacy is sensors and software. Our future is autonomous technologies,” says the Hexagon website. “We are committed to a simple, yet powerful purpose: putting data to work to empower an autonomous future.” These statements could have just as easily been written by Matterport for the Matterport website, as could be said of these additional paragraphs on the Hexagon website: “Hexagon is unlike any other technology company on the planet. What sets us apart is a unique portfolio of sensor, software and autonomous solutions that together are unleashing the power of data to change the world for the better. Our focus is to continually feed a strong R&D base to drive innovation and organic growth, paired with an acquisition strategy that targets emerging and complementary groundbreaking technologies. This combination has transformed Hexagon into a frontrunner in sensors and software and positioned us to lead the autonomous revolution.” “While we’ve always been focused on unleashing data to drive quality, productivity and efficiency, we believe data is also the key to creating sustainable solutions for our planet. Our technologies are shaping vast urban and production ecosystems to become increasingly connected and autonomous – ensuring that sustainability is something that we can scale into the future.” Long-time readers of the We Get Around Network Forum (www.WGANForum.com) – a Matterport-centric community I founded in August 2014 (originally known as the Matterport User Group Forum) following my purchase of a Matterport Pro1 3D Camera in July 2014 – may remember that I predicted in 2016 that Google would acquire Matterport and in 2018 I predicted that Hexagon would acquire Matterport. Obviously, these predictions did not happen. Despite these misses, I am confident that Hexagon will acquire Matterport. Hexagon has already completed 170+ acquisitions “that accelerate our innovation and increase value for our customers.” Hexagon is no stranger to strategic acquisitions to propel growth in its core businesses. I could imagine that the recent collapse in Matterport’s market cap in less than three months to $1.77 billion market capitalization (18 February 2022) from its record high of $7.85 billion (29 November 2021) – and that Matterport has $600+ million in cash on its balance sheet (from going public 23 July 2021 and the completion of redemption public warrants in January) will help realize my latest prediction that Hexagon will acquire Matterport. Hexagon could use Matterport’s cash to help fund the acquisition. Plus, I could imagine Hexagon’s stock price increasing its market cap to at least the amount of the acquisition or simply based on the likely combined synergies between Matterport and Hexagon. The sun, moon and the stars have aligned for Hexagon to acquire Matterport. This is likely a good time for Brenda to invest $500 in Matterport. Six analysis that follow Matterport think so. Perhaps Brenda will get to cash-out her investment before my next manicure. What do you think? Will Hexagon acquire Matterport? WGAN Forum Related Discussions 1. (16 February 2022) Matterport Announces Record 2021 Financial Results; 500,000+ Subscribers 2. (3 February 2022) WGAN-TV eBook | Architects Leverage Matterport Shot with a Leica BLK360 3. (2 February 2022) Video: Intro to Leica BLK2FLY LiDAR Drone with Leica BLK Tech Specialist 4. (2 February 2022) Video: How to Scan with the Leica BLK ARC and Boston Dynamics Spot Robot 5. (31 January 2022) Why Matterport will Build/Sell a Leica BLK360 Clone for Less Than $7,500 6. (27 January 2022) WGAN-TV eBook-Matterport Timeline: 2014-2022 Milestones, Insight and Commentary 7. (18 January 2022) Matterport Announces Completion of Redemption of Public Warrants 8. (20 January 2022) Matterport Capture Services On-Demand: 5 More Countries/21 More Cities 9. (6 January 2022) Matterport Completes Acquisition of Enview: Property Insights and Analytics 10. (22 July 2022) Matterport And Gores Holdings VI Announce Closing of Business Combination 11. (8 February 2021) Matterport Official Media Release: Matterport Going Public 12. (20 January 2020) Why Matterport is Creating a Spatial Data Moat (& Why That's Good for MSPs) 13. (30 April 2018) Why Hexagon will buy Matterport 14. (26 September 2017) Matterport and Leica partnering in 2018 15. (29 August 2017) Matterport and Hexagon’s Multivista Partner to Introduce Next Generation of Immersive 3D Media in Construction Documentation 16. (20 November 2016) Why Google Will Acquire Matterport 17. WGAN Forum posts tagged: MTTR | News | BLK360 Related Articles 1. Yahoo! | Simply Wall Street (19 February 2022) Matterport, Inc. (NASDAQ:MTTR) Analysts Are Reducing Their Forecasts For This Year 2. The Motley Fool (17 February 2022) Here's Why Matterport Just Hit a New All-Time Low on Thursday |

||

| Post 1 • IP flag post | ||

|

MeshImages private msg quote post Address this user | |

I think, one of the reasons why Matterport stock is currently so low, may be the developments coming from AI. Sooner or later every panorama will be "dollhouse-enabled" - also without additional 3D scan data. On the other hand - from my personal point of view - the stock markets are a little bit short-sighted. Because we all know, that Matterport is more than the "dollhouse-3D-tour-company". MSPs can create business-solutions with Matterport. And these solutions have the Matterport standards, which make them interoperable. But facing the competition like the one above, the current situation is very fragile for Matterport and all the business partners. Therefore I hope for Matterport, that find a save haven and will be acquired by one of the 5 Big Tech companies. Google could really benefit from an acquisition, because their streetview product looks soooo outdated now. And Matterport could enable everyone in the world to make a better Google Streetview product with their mobile phones. Same for Facebook, when they realise that the Metaverse cannot be a colorful "3D-low-poly-only-party" for all days. The Metaverse also needs the look of reality and could need some traces to history. And Matterport already has a very nice footprint in the documentation of history with 360 and 3D. |

||

| Post 2 • IP flag post | ||

WGAN Forum WGAN ForumFounder and Advisor Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| @MeshImages Thank you for your thoughtful reply. Are there other companies that might be a good fit to acquire Matterport? Best, Dan |

||

| Post 3 • IP flag post | ||

WGAN Forum WGAN ForumFounder and Advisor Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| @MeshImages Perhaps Skydio ($340 million in VC funding) in a leveraged buyout? With their Skydio 3D Scan solution paired with its Skydio 2+ autonomous drone solutions? Seems like a good fit with Matterport. Skydio brings autonomous 3D drone scanning to Matterport. That checks two boxes that Matterport is missing (autonomous, drone capture). Dan |

||

| Post 4 • IP flag post | ||

|

MeshImages private msg quote post Address this user | |

| @DanSmigrod Skydio is probably burning cash like Matterport. No, I don't see another potential investor. I see Google (Alphabet) as the ideal investor, because with Matterport they could grow their streetview/maps business into the Metaverse (and into buildings). Google could immediately scale Matterports 3D business like they did with YouTube years ago. Here is a good article from Motley Fool on Matterports current situation. |

||

| Post 5 • IP flag post | ||

WGAN Forum WGAN ForumFounder and Advisor Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

Quote:Originally Posted by MeshImages @MeshImages Perhaps a bigger player rolls up Skydio and Matterport before Hexagon AB buys Matterport? Quote: Originally Posted by MeshImages I wrote the following on 20 November 2016: ✓ Why Google Will Acquire Matterport? Your comment got me to re-read it About: Quote: Originally Posted by MeshImages Great read. Seems like every day The Motley Fool writes about Matterport! I posted the article to this WGAN Forum discussion: ✓ Question of the Day: Have you/will you buy stock in Matterport (MTTR)? Dan |

||

| Post 6 • IP flag post | ||

WGAN Forum WGAN ForumFounder and Advisor Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| PR Newswire (25 February 2022) Hexagon acquires ETQ, adding market-leading SaaS-based QMS software platform to its portfolio Much of the Hexagon AB language in this media release (above) would fit perfectly into a media release if/when Mattterport is acquired by Hexagon. Your thoughts? Dan |

||

| Post 7 • IP flag post | ||

WGAN Forum WGAN ForumFounder and Advisor Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| Hi All, FYI ... Brenda bought $500 in Matterport (MTTR) stock around $7.70 per share, she told me Saturday (26 February 2022). Dan |

||

| Post 8 • IP flag post | ||

WGAN Forum WGAN ForumFounder and Advisor Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| NASDAQ (25 March 2022) Down Sharply, Matterport Might Become a Buyout Target | ||

| Post 9 • IP flag post | ||

WGAN Forum WGAN ForumFounder and Advisor Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| Is Matterport (even more of) an acquisition target with $600 million cash on its balance sheet? Source: Matterport via Globe Newswire | 10 May 2022 | ||

| Post 10 • IP flag post | ||

|

ThinkLab private msg quote post Address this user | |

| @DanSmigrod I know some senior management at Hexagon and will reach out to find out what is happening. And they know are concerns with Matterport and all the dealings. Maybe Hexagon can fix Matterport, as Leica dont own their customers. |

||

| Post 11 • IP flag post | ||

WGAN Forum WGAN ForumFounder and Advisor Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| @ThinkLab Matterport had a market cap of $1.08 billion as of Thursday (15 July 2022), according to MarketBeat and $436.2 million in current assets on its balance sheet (as of 10 May 2022). Seems like Hexagon could buy Matterport and help finance the purchase with Matterport's cash! Your thoughts? Dan |

||

| Post 12 • IP flag post | ||

WGAN Forum WGAN ForumFounder and Advisor Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| Hi All, Matterport has $562 million in cash, as of 30 June 2022. I continue to believe this cash may be used to help buy Matterport. Matterport Media Release (10 August 2022) Matterport Announces Second Quarter 2022 Financial Results, with Stronger-than-Expected Subscription Revenue and Non-GAAP EPS Dan |

||

| Post 13 • IP flag post | ||

Pages:

1This topic is archived. Start new topic?