Redfin: 75% of Homebuyers & Sellers Report Changing Plans Due to Inflation16141

Pages:

1

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

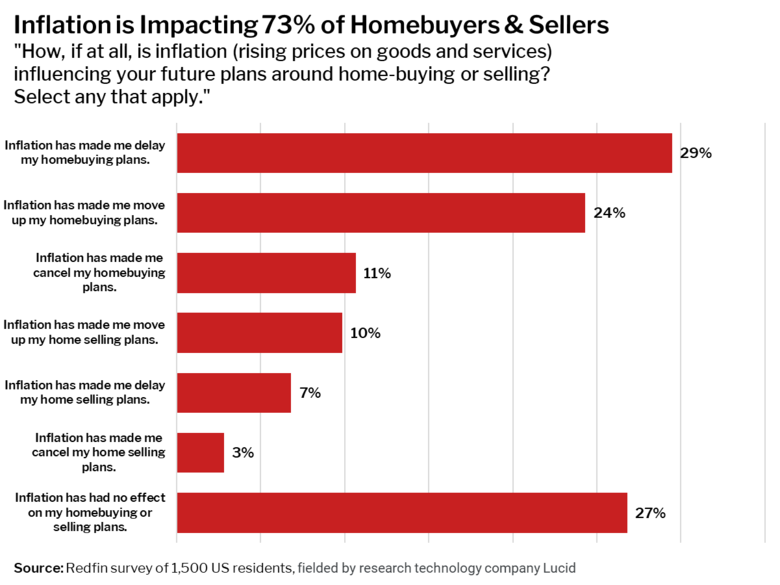

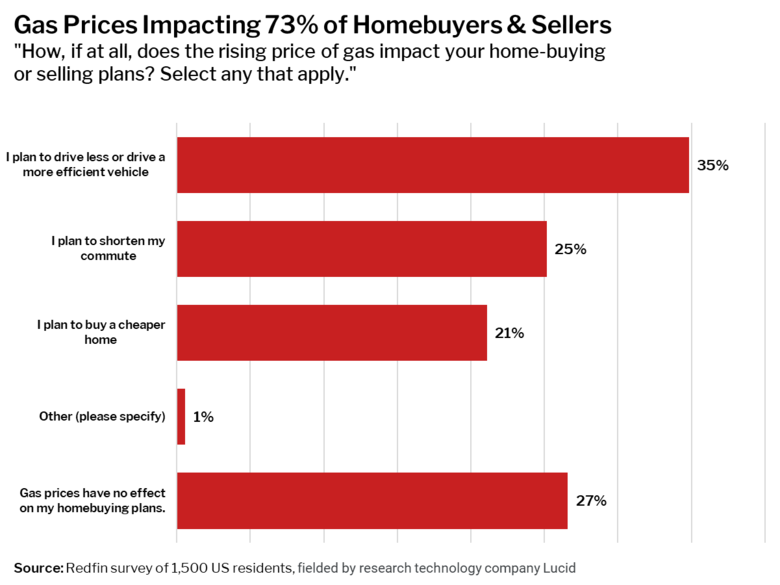

Redfin Media Release Source: Redfin  Source: Redfin Redfin Survey: Three-Quarters of Homebuyers & Sellers Report Changing Plans Due to Inflation Roughly 1 in 10 respondents are cancelling their plans to buy or sell a home because of inflation. 29% are delaying homebuying plans due to inflation, while 24% are accelerating their plans SEATTLE, Dec. 29, 2021 /PRNewswire/ -- (NASDAQ: RDFN) — Seventy-three percent of homebuyers and sellers say inflation is influencing their future buying or selling plans, according to a new report from Redfin (www.redfin.com), the technology-powered real estate brokerage. Responding to a recent Redfin-commissioned survey of Americans who are planning to buy or sell a home in the next 12 months, 29% of respondents said they're delaying homebuying plans due to inflation. Twenty-four percent of respondents are moving up their homebuying plans and 11% are canceling plans altogether. Meanwhile, 10% of respondents said inflation is causing them to move up their home selling plans, 7% are delaying their selling plans and 3% are canceling. "The way Americans interpret news about rising prices can have a variety of effects on their financial decisions, including homebuying," said Redfin Chief Economist Daryl Fairweather. "Some people may delay buying because they're worried that with prices rising on everything from food to fuel, now is not the right time to make a huge purchase. But others might move faster to find a house because they're worried home prices and rent prices will increase even more, and they want to lock in a fixed payment." The survey results come amid reports that inflation is at its highest level in nearly 40 years, with consumer prices jumping 6.8% in November from a year earlier. Increasing prices for gas and other energy sources are driving the inflation surge. Seventy-three percent of survey respondents said rising gas prices are impacting decisions about their homebuying plans or their commute. Thirty-five percent said they plan to drive less or drive a more efficient vehicle because of rising gas prices, while 25% plan to shorten their commutes. Twenty-one percent said they plan to buy a cheaper home. "Different homebuyers react to high fuel prices in different ways, depending on their circumstances," said Redfin Deputy Chief Economist Taylor Marr. "Some people will pay a premium to shorten their commute, while others will opt for a more affordable home to make up for expensive gas or a new – but more fuel-efficient – vehicle." Three-quarters of respondents said the rising cost of home energy is impacting their homebuying or selling plans. Specifically, 36% of respondents said they plan to add energy-saving features to their home, 33% plan to move to a more energy-efficient home and 15% plan to move to a smaller home. To read the full report, including charts and graphs, please visit: https://www.redfin.com/news/inflation-homebuying-survey/ About Redfin Redfin (www.redfin.com) is a technology-powered real estate company. We help people find a place to live with brokerage, instant home-buying (iBuying), rentals, lending, title insurance, and renovations services. We sell homes for more money and charge half the fee. We also run the country's #1 real-estate brokerage site. Our home-buying customers see homes first with on-demand tours, and our lending and title services help them close quickly. Customers selling a home can take an instant cash offer from Redfin or have our renovations crew fix up their home to sell for top dollar. Our rentals business empowers millions nationwide to find apartments and houses for rent. Since launching in 2006, we've saved customers more than $1 billion in commissions. We serve more than 100 markets across the U.S. and Canada and employ over 6,000 people. Source: Redfin via PRNewswire |

||

| Post 1 • IP flag post | ||

Pages:

1This topic is archived. Start new topic?