Matterport 1Q2022 Financial Results with Stronger-than-Expected Revenue16817

Pages:

1

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

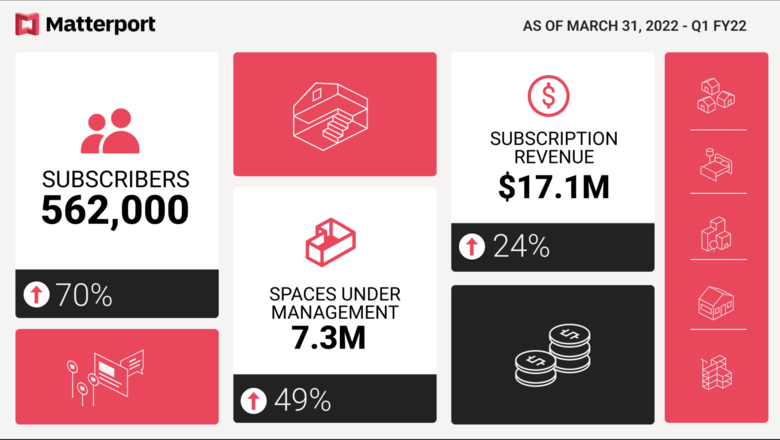

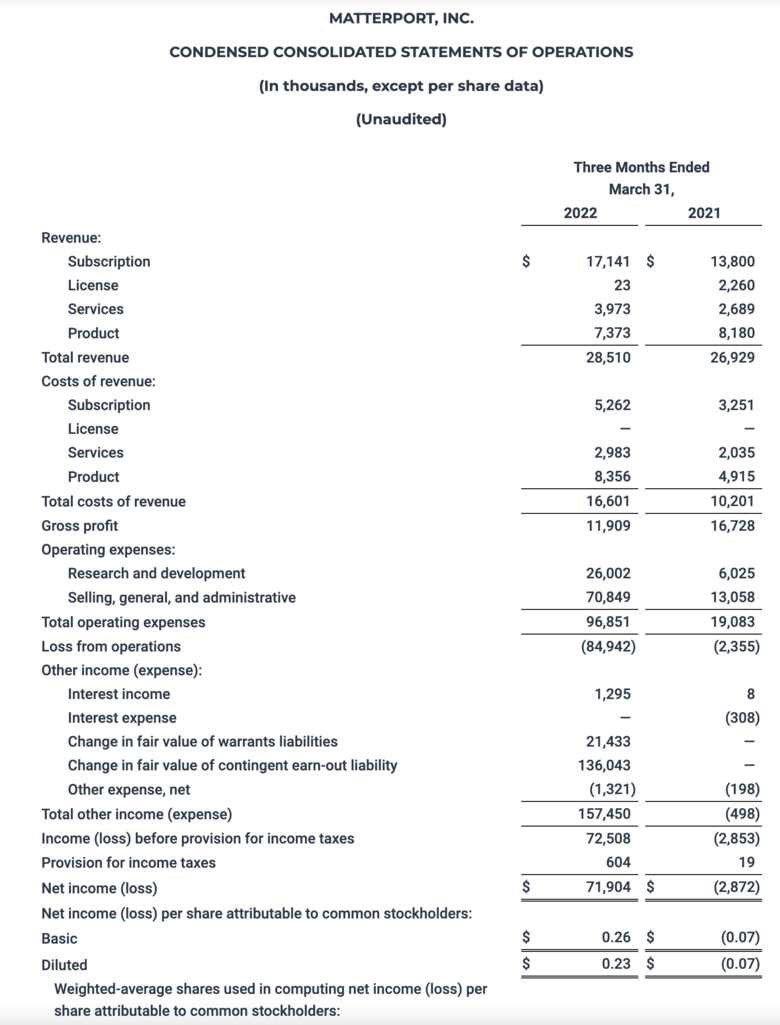

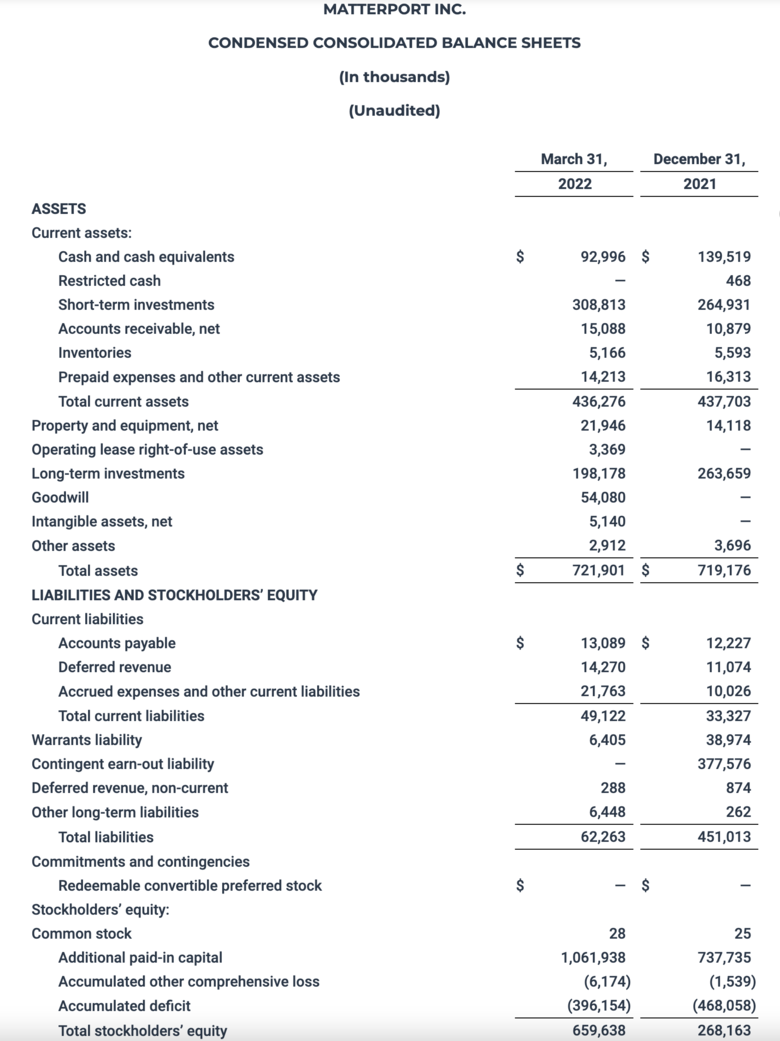

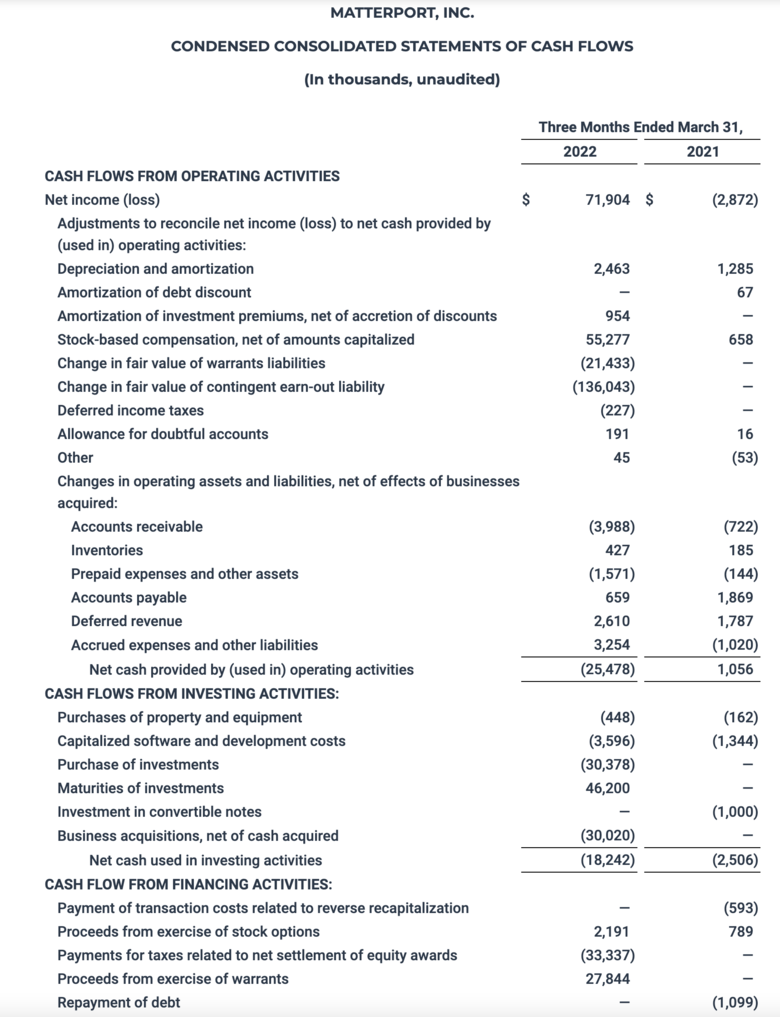

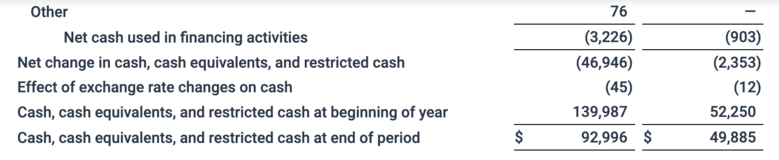

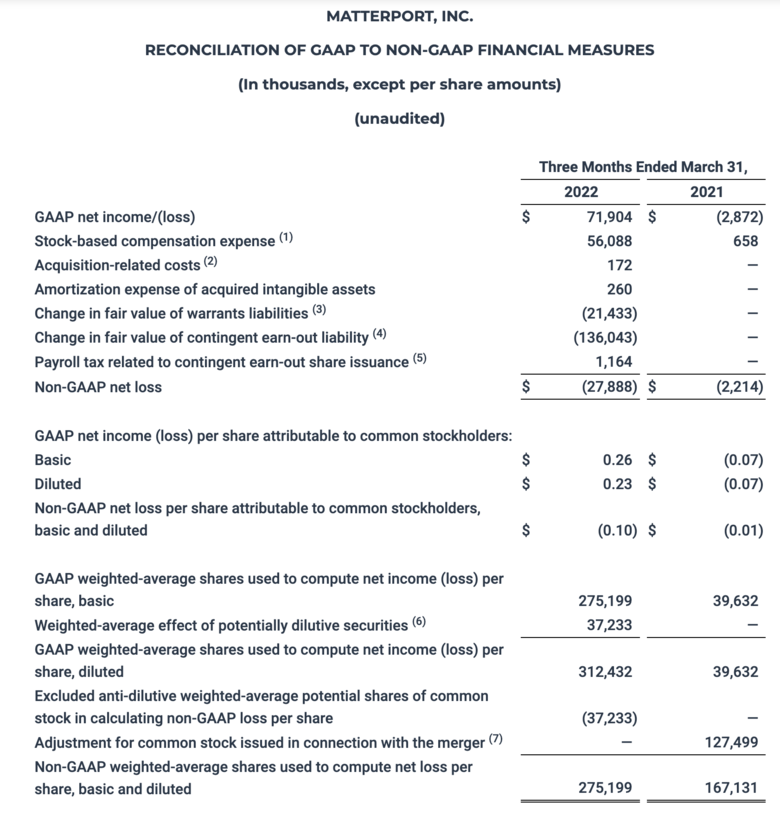

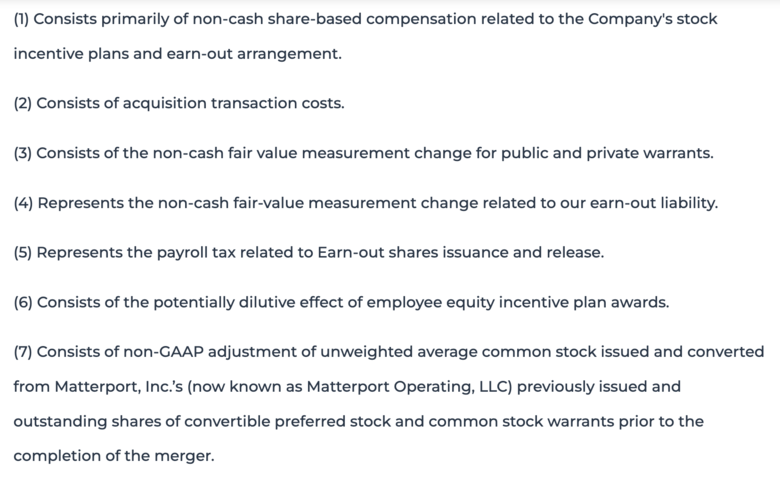

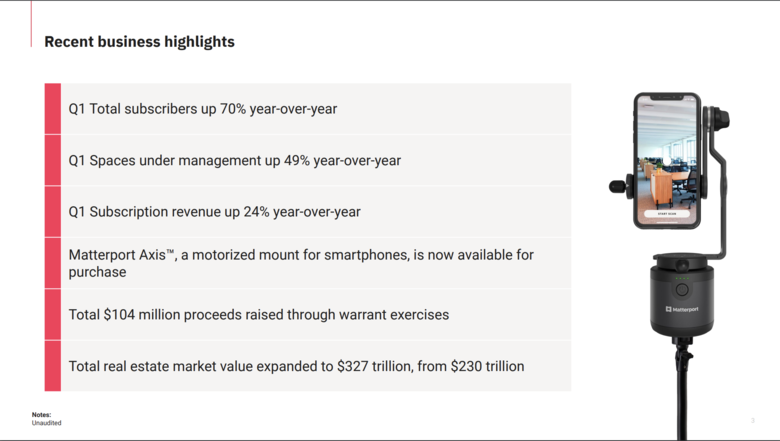

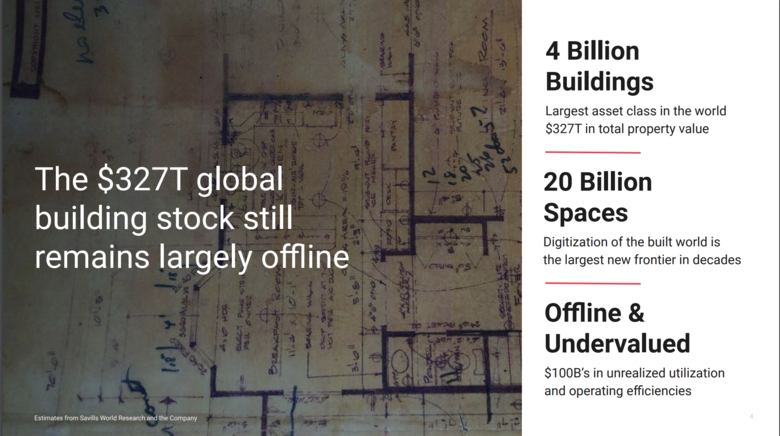

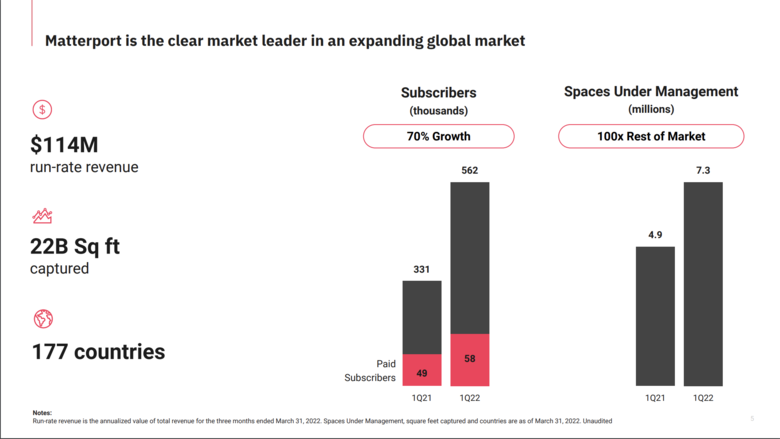

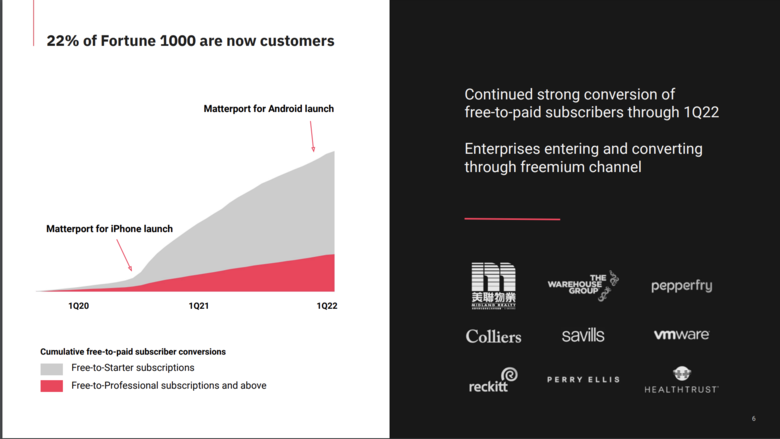

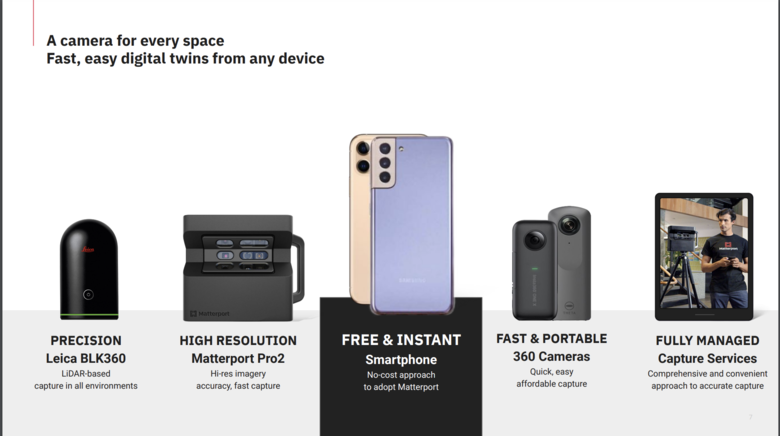

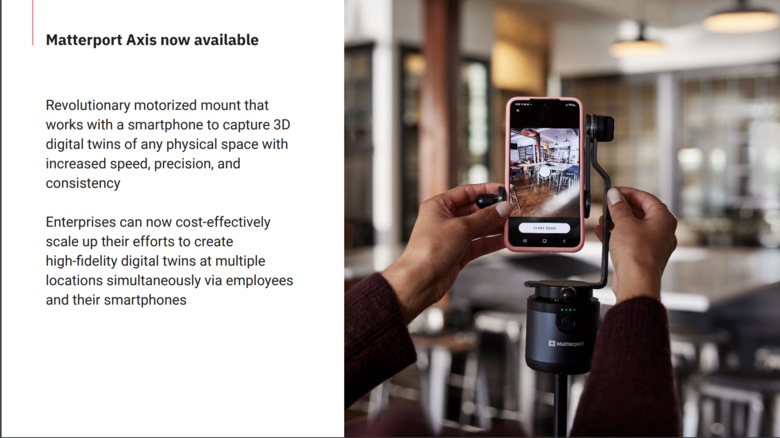

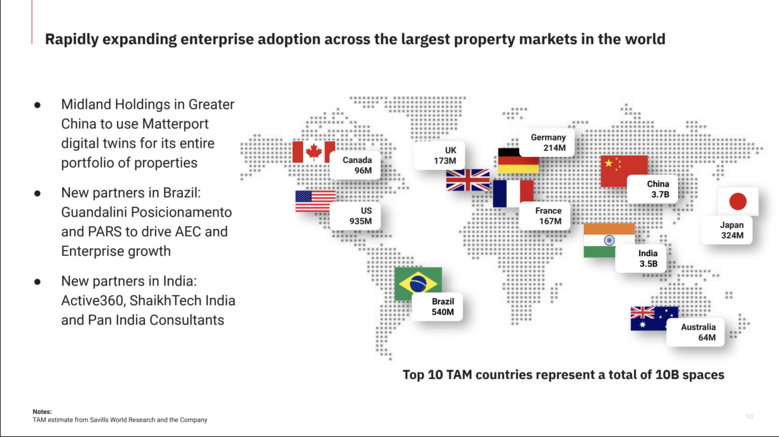

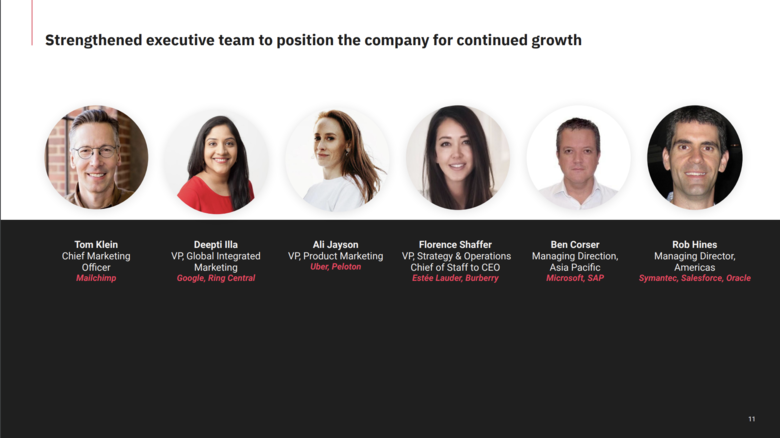

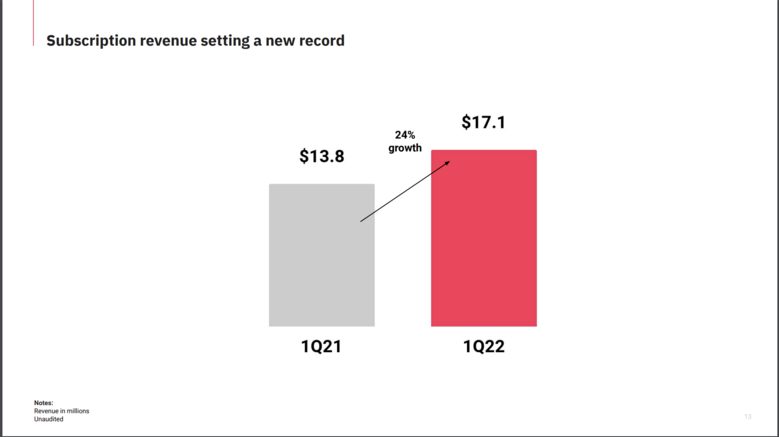

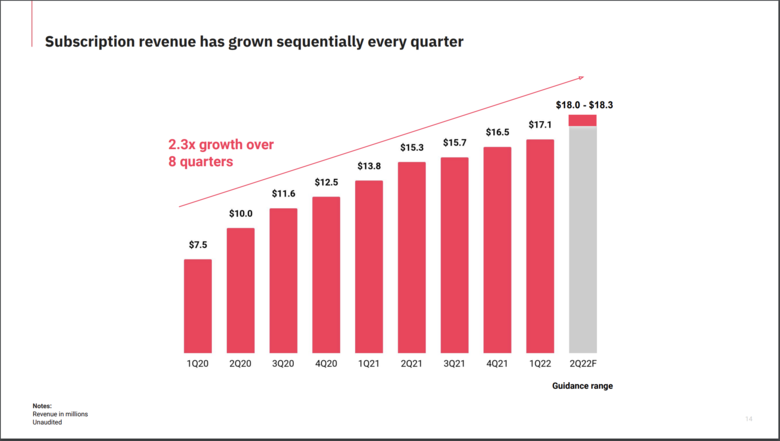

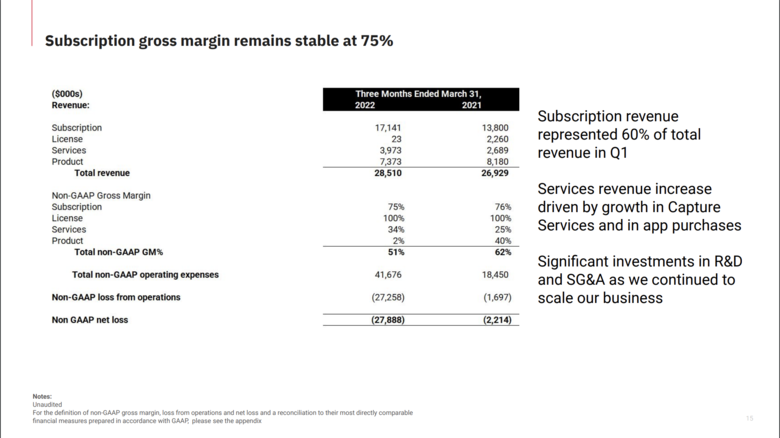

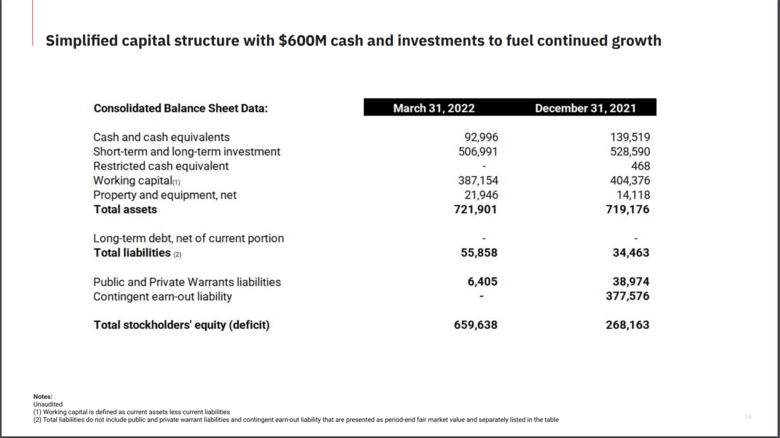

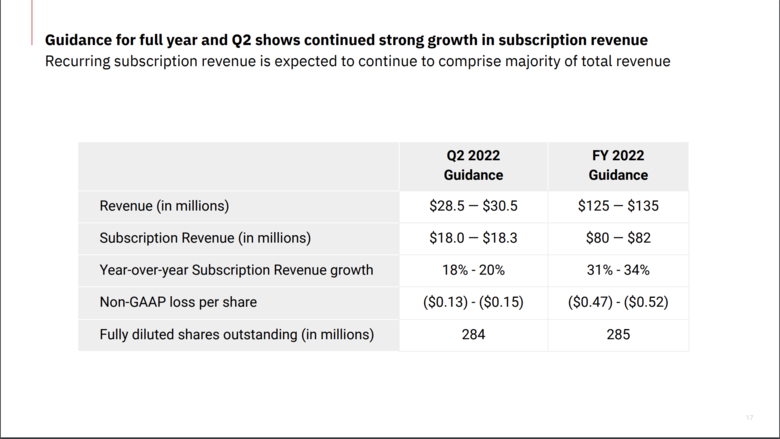

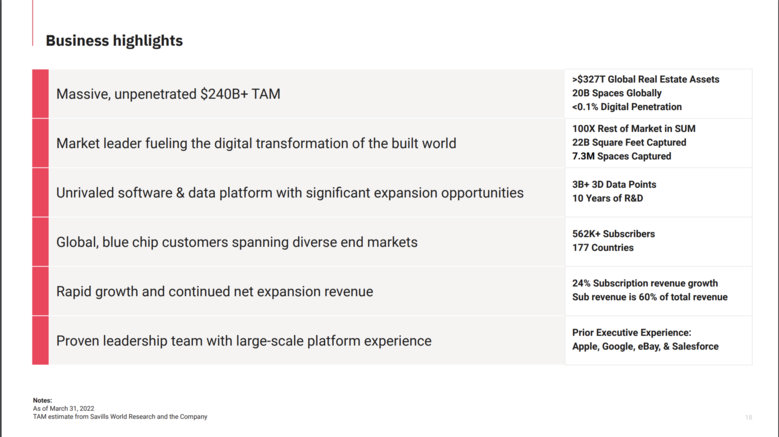

| Matterport Media Release ---  Source: Matterport via Globe Newswire ----- Matterport First Quarter 2022 Earnings Deck | 10 May 2022 ----- Video: Matterport Announces First Quarter 2022 Financial Results with Stronger-than-Expected Revenue | Video courtesy of www.WGAN-TV.com WGAN Forum Podcast #99 Matterport Announces First Quarter 2022 Financial Results with Stronger-than-Expected Revenue 1. Total subscribers increased 70% to 562,000 from year-ago period 2. Subscription revenue rose 24% year-over-year 3. Q1 GAAP diluted earnings per share of $0.23, Non-GAAP loss per share of $0.10 4. Company reaffirms prior guidance for the full year 5. Balance sheet remains strong with $600 million cash and investments and no debt SUNNYVALE, California, Tuesday, May 10, 2022 (GLOBE NEWSWIRE) -- Matterport, Inc. (Nasdaq: MTTR) (“Matterport” or the “Company”), the leading spatial data company driving the digital transformation of the built world, today announced financial results for the quarter ended March 31, 2022. “We are pleased to report another strong quarter, increasing our subscriber count by 70% to 562,000 subscribers for the period. We expanded Spaces Under Management by 49% to 7.3 million spaces — that’s 7.3 million Matterport digital twins of homes, offices, factories, hotels, and so much more,” said RJ Pittman, Chairman and Chief Executive Officer of Matterport. “Real property is the largest asset class in the world, now valued at an estimated $327 trillion, reflecting a $100 trillion increase in value in recent years as more than 15,000 new buildings are completed every day. Matterport is leading the industry with over 7 million digital twins, and we’re creating thousands more each day, while 99% of the world's buildings have yet to be digitized. This enormous market opportunity is expanding, and we remain focused on efficiently scaling Matterport’s business to meet the rising global demand for software-driven property management.” “In addition to strong adoption, we are excited to report our total revenue for the first quarter of 2022 was $28.5 million, $1 million above the high end of our guidance range. In addition, Non-GAAP loss per share of 10 cents for the quarter was three cents better than the top end of our guidance range,” said JD Fay, Chief Financial Officer of Matterport. “One of our key strategic levers is subscription revenue, which increased by 24% year-over-year, comprising over 60% of total revenue for the quarter, and which continues to provide high and stable gross margins. Today, we are re-affirming our prior 2022 revenue and EPS guidance. With $600 million of cash on our balance sheet, we have the financial strength to navigate the macro environment and comfortably achieve our long term business plan,” he added. First Quarter 2022 Financial Highlights 1. Total revenue was $28.5 million, up 6% compared to first quarter of 2021 2. Subscription revenue was $17.1 million, up 24% compared to first quarter of 2021 3. Annualized Recurring Revenue (ARR) of $68.6 million 4. Total subscribers increased to 562,000, up 70% compared to first quarter of 2021 5. Spaces Under Management (SUM) grew to 7.3 million, up 49% compared to first quarter of 2021 Recent Business Highlights 1. Matterport Axis™, a motorized mount for smartphones, is now available for purchase. Matterport Axis, which holds either an iOS or Android device, and can be used with the Matterport Capture app, creates 3D digital twins of any physical space with increased speed, precision, and consistency 2. Announced Midland Holdings, one of the largest residential real estate brokerages in the Greater China region, will become the first brokerage in the region to use Matterport digital twins to create virtual 3D experiences for its entire portfolio of properties 3. Expanded its presence in the Brazilian market via two strategic partners, Guandalini Posicionamento and PARS, to offer Matterport's spatial data platform to their enterprise customers in the architecture, engineering, and construction (AEC) markets. 4. Announced and completed the acquisition of Enview, Inc., a pioneer in the scalable, artificial intelligence (AI) for 3D spatial data 5. Announced the redemption of public warrants, resulting in approximately $104 million in cash proceeds from the warrants prior to redemption 6. Launched social impact program to support nonprofits and public education institutions by enabling equitable access to 3D spaces 7. Won two Comparably Awards, including Best Company Outlook among small/mid-sized companies and Best Places to Work in the San Francisco Bay Area 8. Strengthened Matterport’s executive team through the addition of the following executives: -- Tom Klein, Chief Marketing Officer -- Deepti Illa, Vice President, Global Integrated Marketing -- Ali Jayson, Vice President, Product Marketing -- Florence Shaffer, Vice President, Strategy & Operations, Chief of Staff to CEO -- Ben Corser, Managing Director, Asia Pacific -- Rob Hines, Managing Director, Americas  Source: Matterport Non-GAAP Financial Information Matterport has provided in this press release financial information that has not been prepared in accordance with generally accepted accounting principles in the United States (GAAP). We believe that the presentation of non-GAAP financial information provides important supplemental information to management and investors regarding financial and business trends relating to Matterport’s financial condition and results of operations. The presentation of these non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP financial measures and should be read only in conjunction with the Company’s consolidated financial statements prepared in accordance with GAAP. For further information regarding these non-GAAP measures, including the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures, please refer to the financial tables below. Non-GAAP Net Loss and Non-GAAP Net Loss Per Share, Basic and Diluted. Matterport defines non-GAAP net loss as net income (loss), adjusted to exclude stock-based compensation expense, fair value change of warrants liabilities, fair value change of earn-out liabilities, payroll tax related to contingent earn-out share issuance, acquisition transaction costs, and amortization of acquired intangible assets, in order to provide investors and management with greater visibility to the underlying performance of Matterport’s recurring core business operations. In order to calculate non-GAAP net loss per share, basic and diluted, Matterport uses a non-GAAP weighted-average share count. Matterport defines non-GAAP weighted-average shares used to compute non-GAAP net loss per share, basic and diluted, as GAAP weighted average shares used to compute net income (loss) per share attributable to common stockholders, basic, adjusted to reflect the shares of Matterport’s Class A common stock exchanged for the previously issued and outstanding shares of redeemable convertible preferred stock and common stock warrants of Matterport, Inc. (now known as Matterport Operating, LLC) in connection with the recently completed merger, that are outstanding as of the end of the period as if they were outstanding as of the beginning of the period for comparability, and the potentially dilutive effect of the Company’s employee equity incentive plan awards. Conference Call Information Matterport will host a conference call for analysts and investors to discuss its financial results for the first quarter of fiscal 2022 today at 1:30 p.m. Pacific time (4:30 p.m. Eastern time). A recorded webcast of the event will also be available following the call for one year on the Matterport’s Investor Relations website at investors.matterport.com. About Matterport Matterport, Inc. (Nasdaq: MTTR) is leading the digital transformation of the built world. Our groundbreaking spatial data platform turns buildings into data to make nearly every space more valuable and accessible. Millions of buildings in more than 177 countries have been transformed into immersive Matterport digital twins to improve every part of the building lifecycle from planning, construction, and operations to documentation, appraisal and marketing. Learn more at matterport.com and browse a gallery of digital twins. ©2022 Matterport, Inc. All rights reserved. Matterport is a registered trademark and the Matterport logo is a trademark of Matterport, Inc. All other marks are the property of their respective owners. --- Source: Matterport via Globe Newswire |

||

| Post 1 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

---  ---   ---   Source: Matterport via Globe Newswire |

||

| Post 2 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| Matterport First Quarter 2022 Earnings Deck | 10 May 2022 ---                 Source: Matterport First Quarter 2022 Earnings Deck | 10 May 2022 (More Pages Available) |

||

| Post 3 • IP flag post | ||

|

|

aerialpixels private msg quote post Address this user | |

| Thanks Dan Anyone know what the Revenue streams 'license' and 'services' mean? or have examples? I'm wondering if license means the revenue from Matterport Developer Partners |

||

| Post 4 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| @aerialpixels Sounds like you may have listened to the Matterport, Inc. Fiscal 2022 First Quarter Results Conference Call (recorded) that was live earlier today (Tuesday, 10 May 2022). My Impressions: (Around 21:01 of 56:07) 1. Matterport License Revenue was from the Matterport SDK/API (now as a subscription service) 2. Matterport Services Revenue is from Matterport Capture Services On Demand 3. Matterport Products are camera sales (Matterport Pro2 3D Camera, Matterport Axis rotator) By moving the revenue to subscription from license, Matterport gets to: 1. recognize revenue faster 2. Include in Annual Recurring Revenue (ARR): which is a super-important number (predictable revenue) Does that help? Dan |

||

| Post 5 • IP flag post | ||

|

|

aerialpixels private msg quote post Address this user | |

| Thanks Dan! Regarding SDK/API subscription license, I guess it would include the revenue share generated from the 3rd party MP Developers products? Do you think so too? |

||

| Post 6 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| @aerialpixels For clarification, Matterport is now recognizing SDK/API revenue as a subscription (service) rather than license revenue. While it is likely the same $$$$, it gets reported differently in Matterport's financial statements. Regarding revenue share generates from 3rd party Matterport Developer productions, I do not know the answer to that one. Since this revenue stream is likely not predictable, I could imagine that the revenue gets recognized when received (and not as recurring revenue). Does that help? Dan |

||

| Post 7 • IP flag post | ||

|

|

aerialpixels private msg quote post Address this user | |

| Thanks Dan! | ||

| Post 8 • IP flag post | ||

|

|

Kelvin private msg quote post Address this user | |

| Thanks Dan. Are there any news about pro 3 camera? Is it still worth to buy a pro 2 camera? Especially the Adorama website is providing such a big discount $1500? |

||

| Post 9 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

Quote:Originally Posted by @Kelvin @Kelvin Perhaps this is the Matterport Pro3 (without calling it a Pro3): =>Why Matterport will Build/Sell a Leica BLK360 Clone for Less Than $7,500 Quote: Originally Posted by @Kelvin If you can make more money with the Matterport Pro2 3D Camera, then you should buy it: not wait. (I see that Adorama is still offering the $1,550 discount.) Note: typically a price drop like this would indicate a new camera is on the way. One way to protect yourself is get this Adorama 60 day return option: =>Tip: How to Get 60 Days to Return a Purchase of a Matterport Pro2 Camera Please let us know what you decide to do (and why). Best, Dan |

||

| Post 10 • IP flag post | ||

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

| WGAN Forum Podcast #100 | ||

| Post 11 • IP flag post | ||

|

|

Kelvin private msg quote post Address this user | |

| I decided to wait and see, as there has been so many ‘news’ about the new camera, there is not much point to pay for a pro 2 that is configured with more than 5-6 years old technology that couldn’t do external scanning properly during most of the day time. Just like buying a new iPhone6 when you know the possible release of iPhone 13 is coming… Quote: Originally Posted by DanSmigrod |

||

| Post 12 • IP flag post | ||

WGAN AI WGAN AI Assistant for @DanSmigrod Atlanta, Georgia |

AI_DanSmigrod private msg quote post Address this user | |

| [Note by @DanSmigrod | The headline and first three paragraphs of this Matterport media release were rewritten by AI. [...] indicates an edit by me. I can see using the AI to suggest other/better ways to say the same thing. The two sub-headlines were written by AI too and helped tell the Matterport story.] --- Matterport Announces First Quarter 2022 Financial Results with Stronger-than-Expected Revenue Matterport Continues Momentum with Global Expansion Plans Matterport reaffirms 2022 guidance and announces $600 million cash on balance sheet [SUNNYVALE, California, Tuesday, May 10, 2022 (GLOBE NEWSWIRE) -- Matterport, Inc. (Nasdaq: MTTR) (“Matterport” or the “Company”)] [...] the leading spatial data company driving the digital transformation of the built world, today announced financial results for the quarter ended March 31, 2022. Matterport has announced their first quarter 2022 financial results, with stronger-than-expected revenue. The company saw a 70% increase in subscriber count, with 562,000 subscribers total. [...] This growth is indicative of the increasing demand for Matterport's technology and services. RJ Pittman, Chairman and Chief Executive Officer of Matterport, commented on the success, stating "We are pleased to report another strong quarter... We expanded Spaces Under Management by 49% to 7.3 million spaces [....] In a continued effort to digitize the world's real estate, Matterport has announced their plans for global expansion. [...] CEO RJ Pittman had this to say about the expansion: "Real property is the largest asset class in the world, and we're just getting started. We remain focused on efficiently scaling our business to meet the rising global demand for our technology." With over 7 million digital twins created so far, it's evident that Matterport is leading the industry in this growing field. Matterport has released their first quarter results for 2022, reporting strong adoption and total revenue of $28.5 million. The company also saw a decrease in Non-GAAP loss per share, coming in at 10 cents for the quarter. Chief Financial Officer JD Fay commented on the success, stating that they were "excited to report our total revenue for the first quarter of 2022 was $28.5 million, $1 million above the high end of our guidance range." Fay also noted that they are "pleased with our continued progress towards profitability." With these positive results, it looks like Matterport is well on its way to becoming a profitable and successful business[.] Matterport [...] announced that they are re-affirming their prior 2022 revenue and EPS guidance. The company also announced that they have $600 million of cash on their balance sheet which will help them navigate the current macro environment. [JD Fay, Chief Financial Officer of Matterport] commented on the news, saying "One of our key strategic levers is subscription revenue, which increased by 24% year-over-year, comprising over 60% of total revenue for the quarter, and which continues to provide high and stable gross margins." He added that with this strong financial position, they are well positioned to achieve their [long term business plans.] |

||

| Post 13 • IP flag post | ||

Pages:

1This topic is archived. Start new topic?