Out-of-Town Buyers Have Nearly 30% More to Spend on Homes Than Locals in...16444

Pages:

1

WGAN Forum WGAN ForumFounder & WGAN-TV Podcast Host Atlanta, Georgia |

DanSmigrod private msg quote post Address this user | |

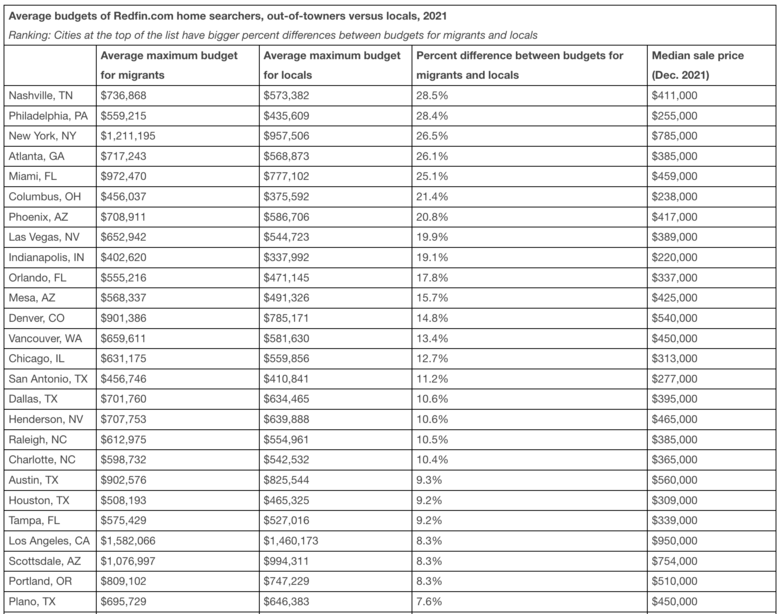

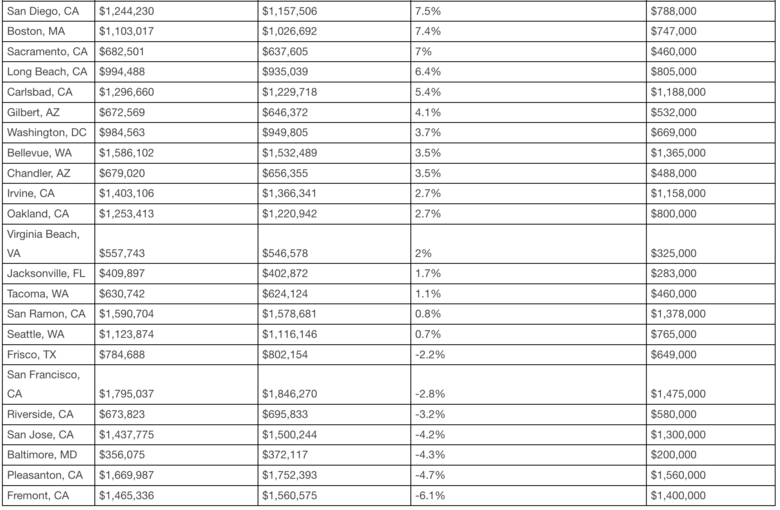

| Redfin Media Release --- WGAN Forum Podcast Out-of-Town Buyers Have Nearly 30% More to Spend on Homes Than Locals in Migration Hotspots Like Nashville, Atlanta and Miami Redfin finds relocators have bigger budgets than locals in 42 of the 49 cities included in its analysis SEATTLE--Tuesday, February 15, 2022--(BUSINESS WIRE)--(NASDAQ: RDFN) — The average out-of-towner moving to Nashville in 2021 had $736,900 to spend on a home, 28.5% higher than the $573,400 average budget for local buyers. That’s according to a new report from Redfin (www.redfin.com), the technology-powered real estate brokerage, which cited Nashville as having the biggest budget gap among the cities included in its analysis. Next comes Philadelphia, with an average out-of-town budget of $559,200—28.4% higher than the average local budget. It’s followed by New York City, where the average out-of-towner had a 26.5% higher budget than the average local, and Atlanta, where migrants had a 26.1% bigger budget. Miami rounds out the top five, with an average out-of-town budget 25.1% higher than that of locals. Out-of-towners have higher budgets than locals in 42 of the 49 cities included in Redfin’s report. Many American homebuyers were able to widen their searches in 2021 as many employers made remote-work options permanent. Remote workers are now able to move somewhere more affordable than their hometown, so it stands to reason that out-of-towners frequently have bigger budgets than locals: They may come from a place with higher salaries, and/or they may have sold a home in a more expensive city. That’s good news for people moving from a place with sky-high home prices like coastal California to an area that’s still comparatively affordable, like Nashville or Atlanta. For instance, the typical home in Los Angeles—the most common origin of people moving to Nashville—sold for $950,000 in December, versus $411,000 in Nashville. The typical home in New York City —the most common origin of people moving to Atlanta and Miami—sold for $785,000, versus $385,000 in Atlanta and $459,000 in Miami. The influx of out-of-towners with big budgets is contributing to the rise in home prices in popular migration destinations, pricing out many locals. Nashville home prices remain lower than many expensive coastal cities, but were up 22.6% in December from the year before. So while Nashville may be a good deal for someone coming from Los Angeles, many locals are stuck renting. “We’re seeing a lot of out-of-state transplants, mostly from states like California that have an income tax,” said Hope Geyer, a Redfin agent in Nashville, where there’s no state income tax. “People moving from the West Coast will pay way over asking price without batting an eye. In their eyes, they’re getting a deal. It’s really hard for locals to compete right now, and it can be devastating for first-time buyers who aren’t able to offset high prices by selling a home before they buy a new one.” Locals have bigger budgets in several Bay Area cities Locals had higher budgets than out-of-towners in seven of the 50 cities in this analysis, most of which are in California: Four Bay Area cities (Fremont, Pleasanton, San Jose and San Francisco) and Riverside, plus Baltimore and Frisco, TX. The average budget for Fremont locals was $1,560,600, about 6% higher than the average budget for out-of-towners. That’s a bigger premium than any other city in this analysis. It’s followed by Pleasanton, where locals had an average budget of $1,752,400, roughly 5% higher than the average migrant budget. Bay Area locals tend to have bigger budgets than people moving in from out of town because they have some of the highest incomes in the country.   Source: Redfin To read the full report, including methodology, please visit: www.Redfin.com/news About Redfin Redfin (www.redfin.com) is a technology-powered real estate company. We help people find a place to live with brokerage, instant home-buying (iBuying), rentals, lending, title insurance, and renovations services. We sell homes for more money and charge half the fee. We also run the country's #1 real-estate brokerage site. Our home-buying customers see homes first with on-demand tours, and our lending and title services help them close quickly. Customers selling a home can take an instant cash offer from Redfin or have our renovations crew fix up their home to sell for top dollar. Our rentals business empowers millions nationwide to find apartments and houses for rent. Since launching in 2006, we've saved customers more than $1 billion in commissions. We serve more than 100 markets across the U.S. and Canada and employ over 6,000 people. For more information or to contact a local Redfin real estate agent, visit www.redfin.com. To learn about housing market trends and download data, visit the Redfin Data Center. To be added to Redfin's press release distribution list, email press@redfin.com. To view Redfin's press center, click here. --- Source: Redfin via BusinessWire |

||

| Post 1 • IP flag post | ||

Pages:

1This topic is archived. Start new topic?